According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges globally exhibit security vulnerabilities. This alarming statistic highlights the urgent need for innovative remittance solutions, especially in dynamic markets like Vietnam. With Vietnam remittance innovations, the landscape of cross-border payments is on the brink of transformation.

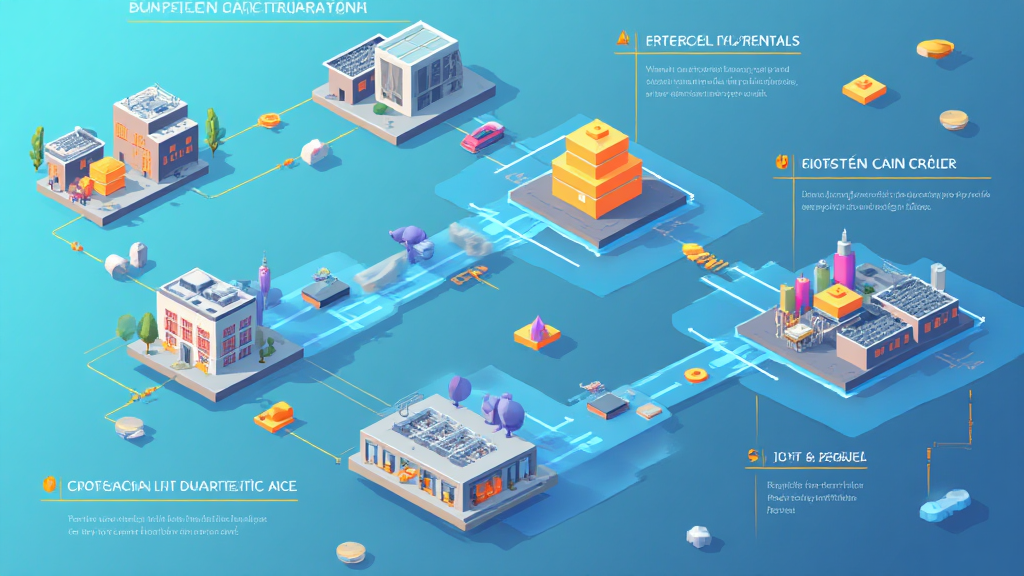

Imagine you need to exchange currency, similar to how you’d approach a currency exchange booth at a busy airport. 2398″>2/”>2532“>Cross-chain interoperability is like having multiple exchange booths that can seamlessly talk to one another, allowing you to convert your Vietnamese Dong to US Dollars and then to other currencies without the hassle of switching platforms. This innovation facilitates smooth transactions across various blockchain networks, bridging the gap between different systems for a more user-friendly experience.

Ever played a game where you need to prove you have certain resources without showing your entire hand? Zero-knowledge proofs allow users to verify transactions without revealing sensitive information. In Vietnam’s remittance landscape, this innovation enhances privacy and security, empowering users with greater control over their financial data while ensuring compliance with regulatory requirements.

Think of this like tracking a package you ordered online. With real-time transaction tracking, users can instantly see the status of their remittance. This level of transparency builds trust and addresses anxieties consumers often feel regarding cross-border transactions. By leveraging advanced technologies, Vietnam’s remittance services are ensuring that customers are always in the loop.

Picture DeFi as a new neighborhood popping up in your city; it needs rules to keep everything in check. Regulatory compliance in the DeFi space is crucial, as it protects users while promoting innovation. By aligning with evolving regulations, Vietnam’s remittance system can embrace innovations while ensuring that they remain safe and user-friendly.

As we navigate the evolving landscape of cross-border payments, innovations like cross-chain interoperability and zero-knowledge proofs are paving the way for safer and more efficient remittance services. We encourage readers to explore tools like the Ledger Nano X, which can mitigate risks of private key exposure by up to 70%. For those interested in understanding these innovations further, download our comprehensive toolkit today!