In the vibrant world of cryptocurrency, especially in Vietnam, selecting the right trading strategy is essential. Did you know that in 2023, Vietnam recorded a 34% growth in crypto users?

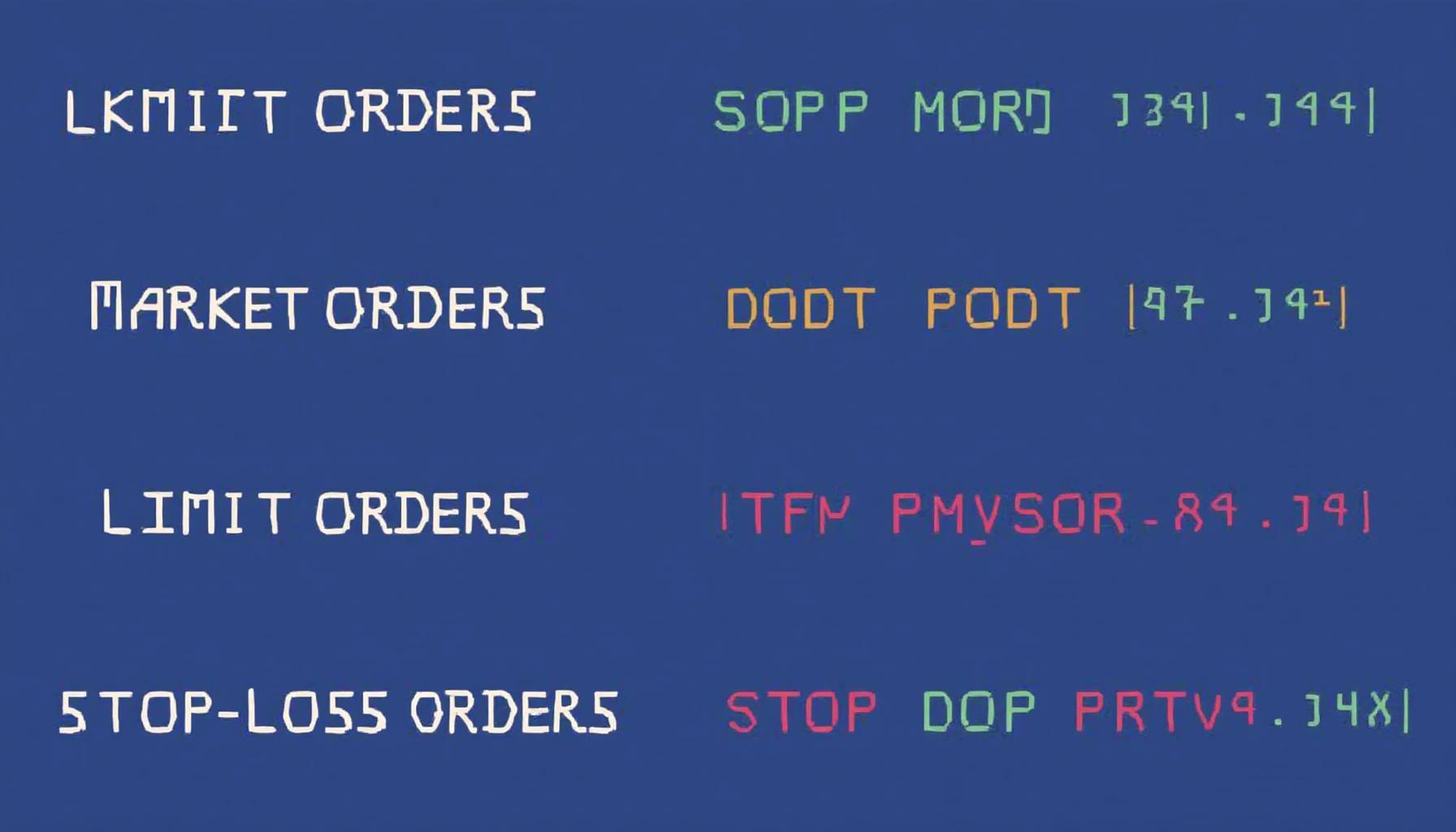

Choosing the correct order type can make a significant difference in your trading outcomes. Here’s a breakdown of the different Vietnam crypto exchange order types:

A market order allows traders to buy or sell a cryptocurrency immediately at the best available price. It’s the simplest order type and is ideal for those who prioritize speed over price. Think of it like purchasing groceries at a store – you grab the items available at the moment without concern for price fluctuations.

Limit orders grant traders control over the price at which they buy or sell. For instance, if you want to buy Bitcoin when it hits a certain price, you set a limit order. This is akin to setting a target while hunting before you pull the trigger.

Stop-loss orders are a tool for minimizing losses. When the price drops to a specific level, your asset sells automatically, similar to a safety net in tightrope walking. Experienced traders often use stop-limit orders, which combine the Stop-Loss order with a limit order to ensure better control over trade executions.

Conditional orders allow traders to set specific conditions for when to place an order. This is similar to setting alarms based on certain events. In the crypto landscape in Vietnam, such features can help mitigate market risks especially in the volatile market.

- Better strategic control: Choosing the right order type can help tailor your strategy.

- Enhanced risk management: Using stop-loss orders can protect against sudden market dips.

- Market insight: Understanding market dynamics enhances decision-making.

As Vietnam’s market continues to evolve, traders must remain informed of the types of orders available on crypto exchanges. This knowledge empowers individuals to make informed trading decisions.

Curious about how these order types could influence your trading success? Check out our trading strategies checklist for more insights.

With various order types like market, limit, stop-loss, and conditional orders, Vietnamese traders can enhance their trading skills in the crypto space. By leveraging these tools, investors can navigate the crypto landscape more effectively, ultimately leading to improved portfolios and gains.

In summary, understanding Vietnam crypto exchange order types is integral for anyone looking to engage in the local cryptocurrency market. As opportunities abound in this explosive sector, users equipped with the right knowledge—like that found on cryptonewscash—will be best positioned to succeed. Remember, the right strategy matched with the right tools can significantly elevate your trading performance.

Author: Dr. Nguyen Minh, a respected blockchain researcher known for publishing over 15 papers in the field and leading audits for prominent digital asset projects.