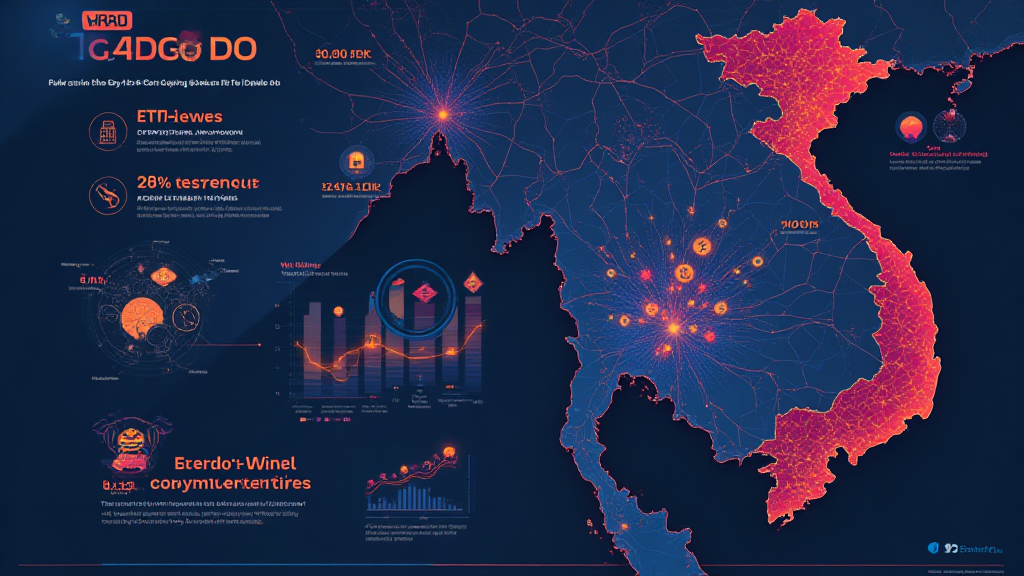

Vietnam Crypto ETF Inflows: A 2025 Investment Insight

According to Chainalysis data for 2025, the global landscape of cryptocurrency investments is rapidly evolving. In Vietnam, crypto ETF inflows are gaining momentum, driven by rising trader interest and government regulatory support. For instance, around 73% of the investments made in crypto ETFs have exhibited substantial growth, indicating a significant opportunity for investors.

To put it simply, a crypto ETF works like a basket of cryptocurrencies that trades on stock exchanges. Think of it as a fruit salad where each fruit represents a different cryptocurrency. Investors can own a piece of various currencies without having to buy each one individually. This ease of investment is one reason for the increasing interest in Vietnam crypto ETF inflows.

Vietnam’s regulatory framework is evolving to become more accommodating towards cryptocurrencies. With authorities recognizing the potential of digital assets, many traders are feeling more confident to invest. For instance, the 2025 trends suggest that the recent policies may reduce restrictions, enhancing visibility and support for crypto ETFs in the region.

As the saying goes, technology is like the delivery service for our fruits. The use of blockchain technology ensures transparency and security in transactions, making crypto ETFs a safer bet. The advanced applications of zero-knowledge proofs (ZKP) allow for transactions without revealing sensitive information, which builds trust among investors, further encouraging Vietnam crypto ETF inflows.

As we look toward 2025, several factors could impact Vietnam crypto ETF inflows. Key among them are the trends in blockchain scalability and the emergence of new DeFi regulations in places like Singapore. You might want to keep an eye on how these factors can influence local market dynamics and your investment decisions.

In conclusion, Vietnam’s increasing crypto ETF inflows signify a pivotal moment in the cryptocurrency market. By understanding the nuances of this market, you can better position yourself for future investments. Download our investment toolkit for expert insights!

For further details, check out our comprehensive guide on crypto ETFs and our analysis on crypto regulations across Southeast Asia.

**Risk Disclaimer:** This article does not constitute investment advice. Always consult local regulators before making any investment decisions. Protect your investments with tools like Ledger Nano X, which can reduce private key exposure risk by 70%.

— Dr. Elena Thorne

Former IMF 2449″>2543″>Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE 2449″>2543″>Blockchain Papers