In the world of cryptocurrencies, there’s a method known as cloud mining, which has become increasingly popular amongst both novice and experienced investors. In this article, we will explore cloud mining in detail, providing you with a comprehensive understanding of how it works, its advantages and disadvantages, various types of contracts available, and essential factors to consider when selecting a reputable provider.

What is Cloud Mining: A Comprehensive Overview

Cloud mining refers to the process of using remote data centers to mine cryptocurrencies. This method allows individuals to buy or rent mining power without having to manage physical mining hardware. The increasing popularity of cryptocurrencies has given rise to numerous cloud mining services that provide customers access to mining capabilities via the internet.

The Evolution of Mining

Mining has evolved significantly since Bitcoin’s inception in 2009. Initially, individuals could mine Bitcoin on standard personal computers. However, as the network grew, so did the complexity of mining, leading to the development of specialized hardware known as ASICs (Application-Specific Integrated Circuits). As a result, only those with significant upfront investments in hardware and electricity could feasibly profit from mining.

Cloud mining emerged as a solution to these challenges, enabling users to bypass the technical barriers associated with traditional mining. By utilizing remote facilities filled with powerful mining rigs, miners can participate in the ecosystem without maintaining equipment at home. This shift not only democratizes access to cryptocurrency mining but also helps mitigate environmental concerns related to excessive energy consumption.

The Appeal of Cloud Mining

The allure of cloud mining lies in its simplicity and accessibility. Individuals interested in mining can enter the market without needing extensive knowledge of mining hardware or software. Additionally, cloud mining contracts often require much lower initial investment than buying hardware directly, making it an attractive option for many.

Moreover, cloud mining eliminates many headaches associated with hardware maintenance, cooling systems, and repairs. Users simply purchase a contract and let the provider handle the operational aspects while they enjoy potential profits.

Common Misconceptions

Despite its growing popularity, some misconceptions persist about cloud mining. One prevalent myth is that all cloud mining operations are scams. While it’s true that the market has attracted fraudulent schemes, many reputable companies exist that offer legitimate services. It is crucial for prospective miners to conduct thorough research and due diligence before investing.

Another misconception is that cloud mining guarantees profits. Like any investment, cloud mining carries risks, and returns depend on multiple factors such as market conditions, mining difficulty, and contract terms.

How Cloud Mining Works: The Core Concepts Explained

As we delve deeper into how cloud mining operates, it is essential to understand the core components involved in the process. Cloud mining essentially connects users to mining infrastructure through the use of contracts, allowing them to mine cryptocurrency remotely.

The Mechanism of Cloud Mining

At its core, cloud mining involves several key players:

- Cloud Mining Provider: These companies own and operate the mining hardware, housing it in data centers with optimal conditions. They are responsible for the maintenance, electricity costs, and overall management of the mining rigs.

- Customers: Individuals seeking to mine cryptocurrencies without managing hardware themselves. Customers purchase contracts that grant them a share of the mined coins based on the amount of hash power they have rented.

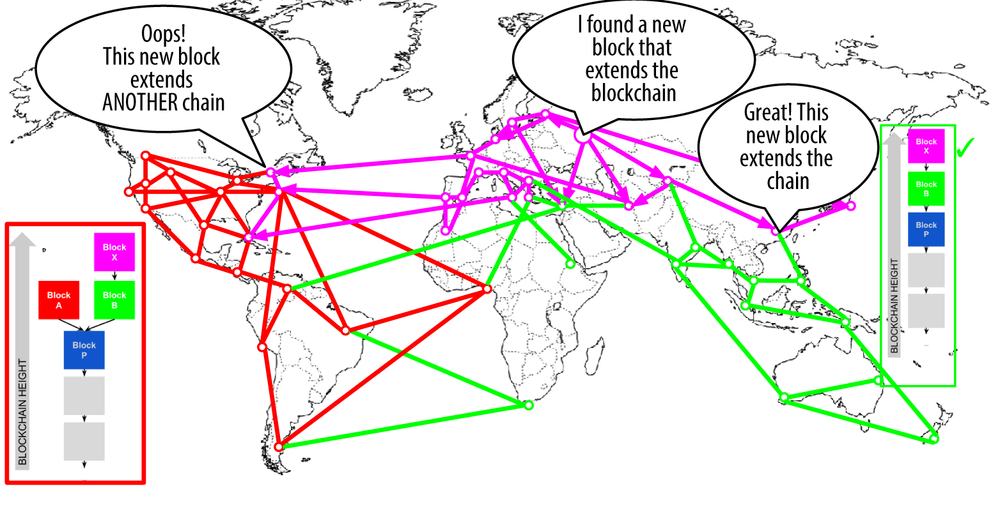

- Blockchain Technology: This is the underlying technology behind cryptocurrencies. Miners validate transactions by solving complex mathematical puzzles, adding new blocks to the blockchain.

When a customer purchases a mining contract, they are essentially renting a portion of the provider’s hashing power, which is then utilized to mine cryptocurrencies. Profits generated from the mining process are divided among customers based on their contributed hash power.

Types of Mining Contracts

There are typically two main types of cloud mining contracts:

- Pay-per-Share Contracts: In this model, miners receive payouts based on their contributions. When a miner contributes to finding a block, they receive a share of the rewards proportional to their contribution.

- PPS (Pay Per Share) Contracts: This structure provides a more stable income stream, as miners are paid for every valid share submitted, regardless of whether a block is found.

Understanding these contract types is crucial as they will influence your potential returns and the risk associated with your investment.

Mining Pools and Their Role

Many cloud mining providers operate mining pools, which combine resources from multiple miners to increase the likelihood of successfully mining a block. By pooling resources, the participants share the risk and reward, leading to more consistent payouts.

However, joining a mining pool may mean that individual miners receive smaller payouts compared to solo mining, though the frequency of receiving payouts may increase significantly.

Pros and Cons of Cloud Mining: Weighing the Opportunities and Risks

Like any investment opportunity, cloud mining comes with its pros and cons. It is vital to evaluate these carefully before deciding if cloud mining aligns with your financial goals.

Advantages of Cloud Mining

- Accessibility: Cloud mining is an excellent entry point for newcomers looking to invest in cryptocurrencies. It does not require substantial upfront investment in hardware or technical knowledge.

- No Maintenance Costs: By using a cloud mining service, customers avoid the headache of managing hardware, electricity bills, and cooling systems. The provider takes care of all necessary maintenance.

- Flexibility: Many cloud mining contracts provide flexible options, such as varying hashing power and contract duration. This flexibility allows users to adapt their investments according to market conditions.

- Location Independence: Since cloud mining is conducted online, you can mine cryptocurrencies from anywhere worldwide without geographical restrictions.

Disadvantages of Cloud Mining

- Lower Profit Margins: Although cloud mining offers convenience, it often comes with higher fees compared to traditional mining methods. Providers usually take a significant percentage of earnings as payment for their services.

- Risk of Scams: The cloud mining space has seen its fair share of scams, and investors must be vigilant when choosing a provider. Unscrupulous operators may disappear with funds or conduct dishonest practices.

- Dependence on Providers: Your success in cloud mining heavily depends on the reliability and efficiency of the provider. If they face technical issues or mismanagement, your profits and mining experience may suffer.

- Market Volatility: The cryptocurrency market is known for its volatility. Fluctuating crypto prices can impact the profitability of mining operations, making it essential to stay informed about market trends.

Types of Cloud Mining Contracts: Selecting the Right Option for You

Choosing the right cloud mining contract requires an understanding of different options available and their potential implications on your investment.

Understanding Contract Types

As discussed previously, two primary types of cloud mining contracts exist: Pay-per-Share and PPS contracts. Here, we’ll delve deeper into each type, including other contract variations.

Pay-Per-Share Contracts

This contract type pays miners based on their contributions to the mining pool. When a miner submits a valid share, they earn a proportionate payout, regardless of whether a block is found. The advantages include more frequent payouts, but returns might be lower per share compared to other models.

PPS Contracts

With a Pay-Per-Share contract, miners receive steady payouts, creating a sense of security in returns. While fees may be higher, the predictability can appeal to those looking for stable income.

Other Variants

While the above contract types are predominant, some cloud mining services may offer unique variants, such as:

- Hashrate Contracts: These allow users to rent a specific amount of hashing power for a predetermined period. Returns depend on the contract length and total hash power rented.

- Lifetime Contracts: These contracts provide users with mining power indefinitely, allowing for potentially long-term gains. However, they often come with higher upfront costs.

Factors to Consider When Choosing Contracts

- Investment Amount: Assess your budget and determine how much you’re willing to invest initially and ongoing.

- Return Potential: Review the historical performance of different contracts offered by providers, including payout frequency and amounts.

- Contract Duration: Evaluate how long you intend to remain invested and choose a contract that aligns with your timeframe.

- Reputation of Providers: Always research the cloud mining provider’s reputation, including user reviews and feedback regarding their contract offerings.

Identifying Reputable Cloud Mining Providers: Due Diligence and Trust Factors

Choosing a reliable cloud mining provider is critical for success in the industry. Conducting thorough due diligence will minimize the risk of falling victim to scams.

How to Identify Trustworthy Providers

When assessing potential cloud mining providers, look out for the following characteristics:

- Transparency: Reputable providers are open about their operations, including facility locations, hardware used, and fee structures. Look for detailed information on their website.

- User Reviews and Feedback: Research online for user experiences and reviews. Trustpilot and Reddit can be valuable resources for gathering insights on a provider’s reliability.

- Customer Support: A trustworthy provider should offer responsive and accessible customer support. Investigate their communication channels, response times, and availability.

- Industry Standing: Established providers often have a proven track record and a solid reputation within the cryptocurrency community. Look for certifications or affiliations with recognized organizations.

Red Flags to Watch For

Be cautious of the following warning signs that may indicate a cloud mining provider is not trustworthy:

- Unrealistic Promises: Be skeptical of providers promising sky-high returns with little to no risk. Mining profitability is subject to various factors, and no provider can guarantee profits.

- Lack of Transparency: Avoid providers that do not provide clear information about their operations or fail to respond to inquiries promptly.

- Poor Reviews: If a provider has numerous negative reviews or complaints regarding payment delays or fraud, it’s wise to reconsider your options.

Verifying Company Credentials

Before committing to a contract, verify the company’s credentials. Check for registration details, licenses, and whether they are compliant with local regulations. This step will help ensure you’re dealing with a legitimate entity in the cloud mining space.

Is Cloud Mining Profitable? Factors Influencing Returns and Long-Term Viability

Profitability in cloud mining is a complex issue influenced by several variables. Understanding these factors can help you make informed decisions about your investments.

Key Factors Affecting Profitability

- Cryptocurrency Prices: The value of the cryptocurrency being mined directly impacts profitability. Rising prices can lead to increased earnings, while declining prices can cut into your returns.

- Mining Difficulty: As more miners join the network, the mining difficulty increases. This affects how easily new blocks can be mined and therefore influences your earnings.

- Contract Terms and Fees: Different contracts carry varying fees and terms that can affect your net earnings. High fees can diminish your profits, so it’s crucial to compare multiple contracts before making a decision.

- Electricity Costs: Since cloud mining providers incur costs for electricity, any fluctuations in these expenses can directly affect profitability. Opt for providers who utilize renewable energy sources to help mitigate these risks.

Analyzing Long-Term Viability

While short-term profits can be enticing, evaluating the long-term viability of cloud mining is crucial. Some aspects to consider include:

- Technological Advancements: Monitor advancements in mining technologies and shifts toward more efficient models. The evolution of hardware can influence the competitive landscape in mining.

- Market Regulation: The regulatory environment surrounding cryptocurrencies varies by country and can impact cloud mining operations. Staying informed about regulations can help anticipate changes that might affect profitability.

- Diversification Strategies: Consider diversifying your investments across different cryptocurrencies and cloud mining contracts. This approach can help mitigate risks associated with market volatility.

The Role of Market Sentiment

Lastly, market sentiment can play a significant role in cloud mining profitability. Positive news about cryptocurrency adoption or technological developments may lead to price surges, while negative news can have the opposite effect. Staying updated on market trends and sentiment can provide better insight into potential profitability.

Conclusion

In summary, cloud mining serves as a viable avenue for individuals looking to venture into the cryptocurrency mining landscape without the complexities of traditional mining. By understanding the fundamentals of cloud mining, evaluating the pros and cons, discerning between various contract types, and investigating reputable providers, investors can navigate this dynamic field effectively. Monitoring key factors influencing profitability and market sentiment will further enhance strategic decisions, ensuring a well-informed and potentially lucrative experience in the world of cloud mining.