In the ever-evolving landscape of blockchain technology, Proof of Work vs Proof of Stake stands at the forefront of discussions surrounding consensus mechanisms. As cryptocurrencies continue to gain traction and adoption, understanding these two paradigms is crucial for anyone looking to navigate the complexities of digital currencies. This article aims to provide an in-depth analysis of both Proof of Work (PoW) and Proof of Stake (PoS), detailing their principles, strengths, weaknesses, and future implications.

Introduction: Understanding Blockchain Consensus Mechanisms

At its core, blockchain technology relies on consensus mechanisms to validate transactions and maintain a secure network. These mechanisms are essential because they ensure that all participants in the network agree on the state of the blockchain. Without a system to achieve consensus, it would be impossible to maintain a decentralized ledger where trust is distributed rather than centralized.

Consensus mechanisms can be broadly categorized into various types, with Proof of Work and Proof of Stake being the most prominent among them. Each method has its unique approach to achieving consensus while presenting its own set of advantages and challenges.

In this article, we will explore the intricacies of PoW and PoS, examining how they function, their security implications, environmental impacts, and their future role in the blockchain ecosystem.

Proof of Work (PoW): Principles, Strengths, and Limitations

The concept of Proof of Work was first introduced by Satoshi Nakamoto in the original Bitcoin whitepaper back in 2008. PoW serves as the foundational consensus mechanism for Bitcoin and many other cryptocurrencies. It requires participants, known as miners, to solve complex mathematical problems in order to validate transactions and add new blocks to the blockchain.

How Proof of Work Functions

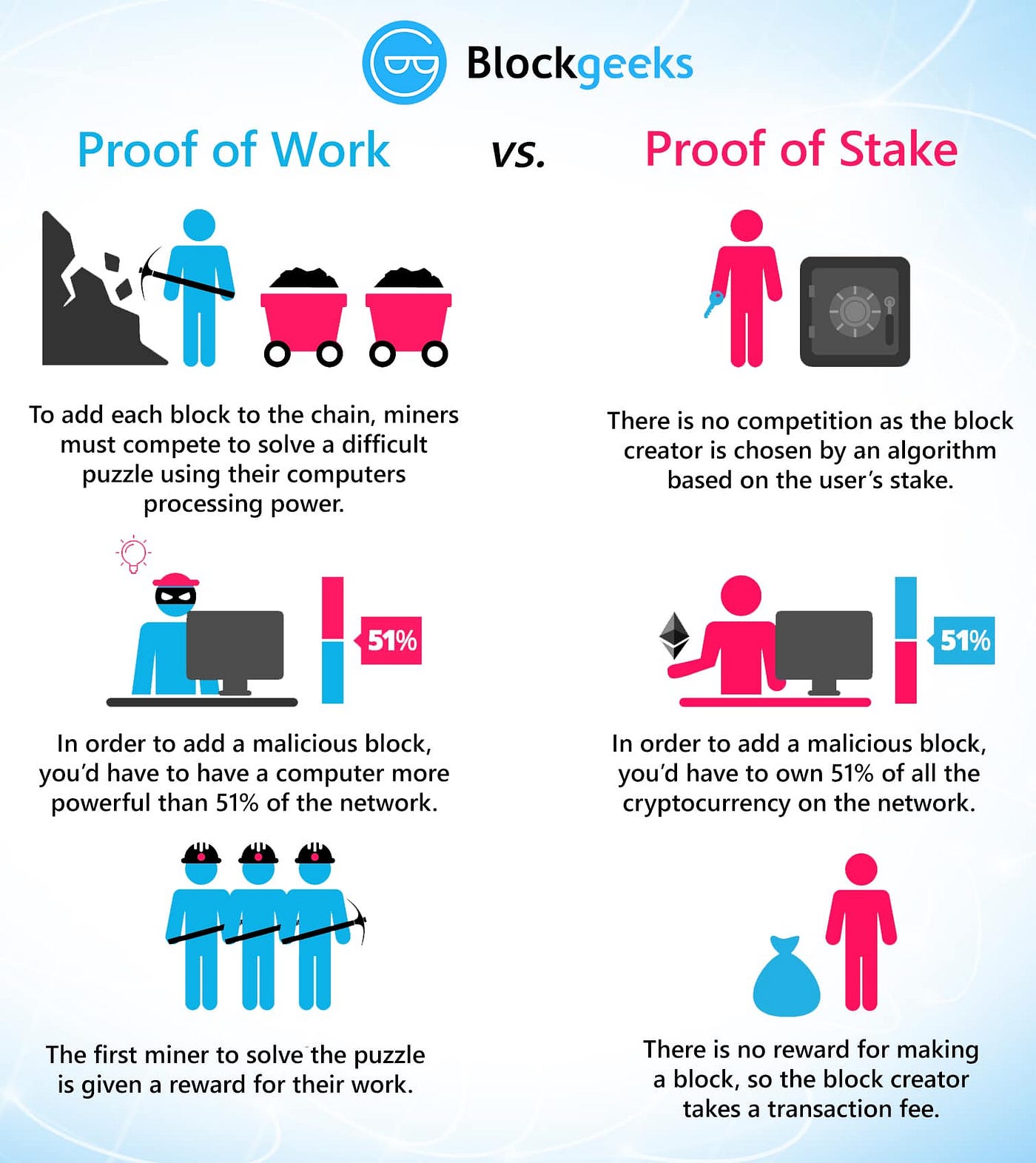

At the heart of Proof of Work lies the process of mining. Miners compete against each other to solve cryptographic puzzles, and the first one to find the solution gets to add the next block to the blockchain.

This process involves:

- Complex Calculations: The puzzles require significant computational power, which is why miners use specialized hardware to increase their chances of solving them quickly. The difficulty of these puzzles automatically adjusts based on the total computational power in the network to ensure that blocks are added at regular intervals.

- Transaction Validation: Once a miner finds the solution, they broadcast it to the network along with the new block containing transaction data. Other nodes verify the solution, ensuring that the miner followed the rules of the protocol.

- Reward System: Successful miners receive rewards in the form of cryptocurrency (e.g., Bitcoin) and the associated transaction fees. This incentivizes miners to participate and secure the network.

Strengths of Proof of Work

Despite some criticisms, PoW has several strengths that make it a popular choice for securing blockchain networks:

- Security: The substantial computational power required to manipulate the network makes PoW highly secure against attacks. To alter a block on the blockchain, an attacker would need to possess over 50% of the total hash rate, which is virtually impossible for large networks like Bitcoin.

- Decentralization: PoW promotes decentralization as anyone with the right hardware can participate in mining. This accessibility means that no single entity can easily control the network.

- Proven Track Record: Bitcoin’s success since its inception demonstrates the effectiveness of PoW in providing a secure and reliable blockchain environment.

Limitations of Proof of Work

However, PoW is not without its drawbacks:

- Energy Consumption: The energy-intensive nature of PoW has led to significant environmental concerns. Mining operations consume enormous amounts of electricity, contributing to carbon emissions and raising sustainability issues.

- Centralization of Mining Power: Over time, mining has become concentrated in areas with cheap electricity and access to advanced hardware. This centralization can undermine the original vision of a decentralized network.

- Scalability Issues: As more users join the network, the time and resources required to mine new blocks can lead to congestion, resulting in slower transaction times and increased fees.

Proof of Stake (PoS): Principles, Advantages, and Disadvantages

In response to the limitations of Proof of Work, the concept of Proof of Stake emerged as an alternative consensus mechanism. PoS was designed to address issues related to energy consumption and scalability while maintaining a high level of security.

How Proof of Stake Works

Proof of Stake operates on a fundamentally different principle from PoW. Instead of relying on computational power to validate transactions, PoS assigns the right to create new blocks based on the number of coins a participant holds and is willing to “stake” as collateral.

Key components of PoS include:

- Staking: Participants lock up a certain amount of cryptocurrency in the network as a stake. The likelihood of being chosen to validate a block increases with the size of the stake, creating an economic incentive to act honestly.

- Block Generation: Validators, also known as “forgers,” are randomly selected to create new blocks based on their stake and other factors such as the age of the coins staked. This minimizes the competition seen in PoW mining.

- Incentives and Penalties: Validators receive rewards for successfully validating transactions but may lose a portion of their stake if they behave maliciously or fail to validate transactions properly.

Advantages of Proof of Stake

PoS comes with several advantages that have led to its increasing popularity among newer blockchain projects:

- Energy Efficiency: By eliminating the energy-intensive mining process, PoS significantly reduces the environmental impact associated with securing the network. This makes PoS a more sustainable option for future blockchain projects.

- Lower Barriers to Entry: PoS allows users to participate in securing the network without needing expensive mining hardware. This opens up opportunities for more individuals to engage in the process.

- Scalability: PoS can handle a higher number of transactions per second compared to PoW, allowing networks to scale more efficiently as user demand increases.

Disadvantages of Proof of Stake

Despite its advantages, Proof of Stake is not without its challenges:

- Security Concerns: While PoS has proven to be secure, it is still a relatively newer mechanism compared to PoW. Critics argue that it may be susceptible to a different type of attack known as long-range attacks or nothing-at-stake issues.

- Wealth Concentration: Critics claim that PoS might inadvertently favor wealthy participants who have more coins to stake, leading to centralization and potential oligopoly-like situations within the network.

- Complexity: The mechanics of PoS can be more challenging to understand and implement compared to PoW. This complexity may deter some developers or investors from adopting PoS-based systems.

Security Comparison: PoW vs. PoS Resilience to Attacks

When discussing Proof of Work vs Proof of Stake, one of the primary considerations is the security of the respective mechanisms. Both PoW and PoS have unique approaches to safeguarding their networks against attacks, but they also exhibit vulnerabilities that must be considered.

Attack Vectors for Proof of Work

PoW is generally known for its resilience against various forms of attack, particularly due to the substantial investment of resources required for manipulation. Some common attack vectors in PoW include:

- 51% Attack: If a single entity gains control of more than 50% of the network’s hash rate, it could potentially double spend coins or block transactions. However, executing such an attack is financially burdensome and logistically complex.

- Sybil Attacks: In theory, attackers could create multiple pseudonymous identities to gain influence over the network. However, the requirement for substantial computational power limits the feasibility of this approach.

Attack Vectors for Proof of Stake

While PoS exhibits robust security features, there are specific attack vectors to consider:

- Nothing-at-Stake Problem: Validators can cast votes for multiple competing forks since there is no cost associated with doing so, unlike in PoW where miners incur costs through energy usage. This poses a challenge for reaching consensus.

- Long-Range Attacks: An attacker with a significant stake could create a long chain of blocks starting from a point far back in the history of the blockchain, effectively disregarding the current active chain.

Comparative Analysis of Security Features

| Consensus Mechanism | Attack Resilience | Cost of Attack | Time to Execute Attack |

|---|---|---|---|

| Proof of Work | High | Very High | Long |

| Proof of Stake | Moderate to High | Variable (depends on stake) | Short |

Both PoW and PoS offer distinct advantages in terms of security, yet they also present unique vulnerabilities. As new technologies and methodologies evolve, the focus remains on enhancing the resilience and integrity of these systems.

Energy Consumption and Scalability: Environmental Impact and Transaction Throughput

As concerns around climate change intensify, the energy consumption associated with blockchain networks has come under scrutiny. A significant aspect of the debate between Proof of Work vs Proof of Stake is how each mechanism affects the environment and their ability to scale effectively.

Energy Consumption of Proof of Work

The energy footprint of PoW networks is notoriously high, primarily due to the resource-intensive nature of mining.

- Electricity Usage: Bitcoin mining, for example, consumes more energy than some countries. This has led to widespread criticism from environmental advocates who argue that PoW contributes to climate change.

- Carbon Footprint: Many mining operations rely on fossil fuels, exacerbating their environmental impact. Efforts to utilize renewable energy sources are underway, but they remain a small fraction of the overall energy consumed.

Energy Efficiency of Proof of Stake

In contrast to PoW, PoS operates with significantly lower energy requirements, making it a more environmentally friendly alternative.

- Minimal Resource Requirement: Validators do not require expensive hardware or vast energy resources, as their role is determined by the cryptocurrency they stake rather than computational power.

- Focus on Sustainability: The reduced energy consumption improves the sustainability of PoS-based networks, making them attractive options for those concerned about ecological preservation.

Scalability Considerations

Another critical aspect to evaluate is scalability—how well each mechanism can handle increasing transaction volumes without compromising performance:

- Scalability Challenges of Proof of Work: PoW networks often experience congestion during periods of high demand. Transactions can take longer to confirm, and fees may spike as users compete to have their transactions included in the next block.

- Scalability Solutions in Proof of Stake: PoS has the potential to support a larger number of transactions per second due to its faster validation process. Additionally, many PoS networks are exploring innovative solutions such as sharding and layer-2 scaling techniques to enhance throughput.

The Future of Consensus: Trends and Hybrid Approaches

As blockchain technology continues to advance, the conversation surrounding Proof of Work vs Proof of Stake is evolving. New trends and hybrid approaches are emerging to tackle the limitations of each consensus mechanism while capitalizing on their strengths.

Emerging Trends in Consensus Mechanisms

Several developments are shaping the discourse on blockchain consensus today:

- Layer-2 Solutions: Protocols like Lightning Network for Bitcoin and Plasma for Ethereum aim to enable faster, cheaper transactions while maintaining the security of the underlying PoW or PoS networks. These solutions create secondary layers that handle smaller transactions off-chain, reducing the burden on the main blockchain.

- Delegated Proof of Stake: Some networks are adopting a variant of PoS where stakeholders elect delegates to validate transactions on their behalf. This approach combines elements of both PoW and PoS while promoting decentralization and efficiency.

Hybrid Models: Combining the Best of Both Worlds

To mitigate the weaknesses of both PoW and PoS, some projects are experimenting with hybrid consensus models:

- Proof of Authority: In this model, a limited number of approved validators are given the authority to confirm transactions. This allows for faster processing while maintaining a level of trust and accountability.

- Proof of Burn: This method involves “burning” a cryptocurrency by sending it to an unspendable address. Participants demonstrate their commitment to the network by sacrificing coins, which can influence their chances of becoming validators.

The Road Ahead: Conclusion

As we look to the future of blockchain technology, the ongoing debate of Proof of Work vs Proof of Stake will certainly dominate discussions on consensus mechanisms. Each approach offers unique strengths and addresses different challenges inherent to securing decentralized networks.

Both PoW and PoS have demonstrated their viability in real-world applications, but their environmental impact and scalability limitations call for innovative solutions and continuous evolution. The emergence of hybrid models and Layer 2 solutions provides valuable pathways toward a more efficient and sustainable blockchain ecosystem. Ultimately, the future of consensus mechanisms will likely hinge upon balancing security, decentralization, and environmental stewardship, paving the way for the next generation of blockchain technology.