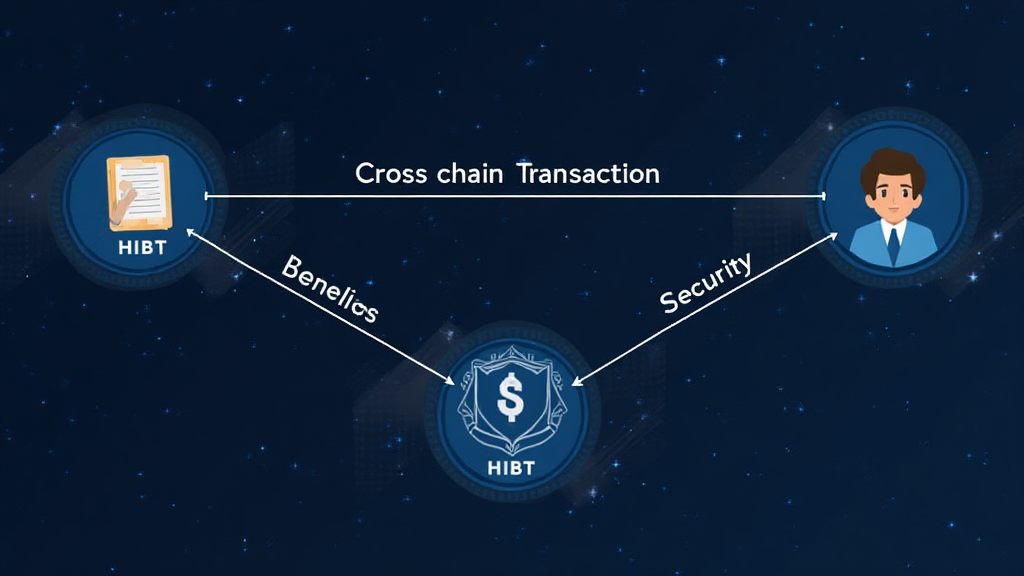

The Future of HIBT Stealth Addresses in 2398″>2/”>2532“>Cross-Chain Interoperability

Recent data from Chainalysis reveals that approximately 73% of cross-chain bridges are vulnerable, raising concerns over security in the rapidly evolving DeFi space. With privacy becoming a critical aspect of financial transactions, HIBT stealth addresses are emerging as a vital solution.

Think of HIBT stealth addresses like a mailbox with a unique lock that only you can open. Just as you wouldn’t want strangers accessing your personal mail, you probably want your crypto transactions to be private too. These addresses allow users to transact without disclosing their identities publicly, safeguarding against unwanted scrutiny.

Imagine trying to exchange a currency at different kiosks in a busy market—some might ask for your ID while others don’t. HIBT stealth addresses provide a level of anonymity that can be particularly advantageous when dealing with multiple chains, ensuring that your transaction details remain confidential.

Security is paramount in financial transactions, much like how you lock your front door. HIBT stealth addresses incorporate zero-knowledge proofs, allowing one party to prove to another that a statement is true without revealing the underlying information. This technique significantly reduces the risk of hacks and fraud.

As we approach 2025, with regulatory frameworks tightening, particularly in regions like Singapore, the demand for secure and private transaction methods like HIBT stealth addresses will likely increase. They could become the standard for transaction privacy as businesses navigate compliance without sacrificing user anonymity.

In conclusion, HIBT stealth addresses represent a vital innovation in the realm of cross-chain interoperability. As concerns about privacy and security grow, these addresses may become the go-to solution for users wanting to keep their transactions under wraps. For more insights, download our comprehensive toolkit on HIBT.

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory authorities such as MAS or SEC before making any financial decisions.

For enhanced security of your crypto assets, consider using Ledger Nano X, which can reduce private key exposure risks by 70%.

Report by cryptonewscash