2025 2398″>2/”>2532“>Cross-Chain Bridge Security Audit Guide

According to Chainalysis, a staggering 73% of cross-chain bridges currently hold vulnerabilities that could jeopardize user funds. This alarming statistic underscores the urgency for robust solutions in the realm of HIBT decentralized exchange protocols.

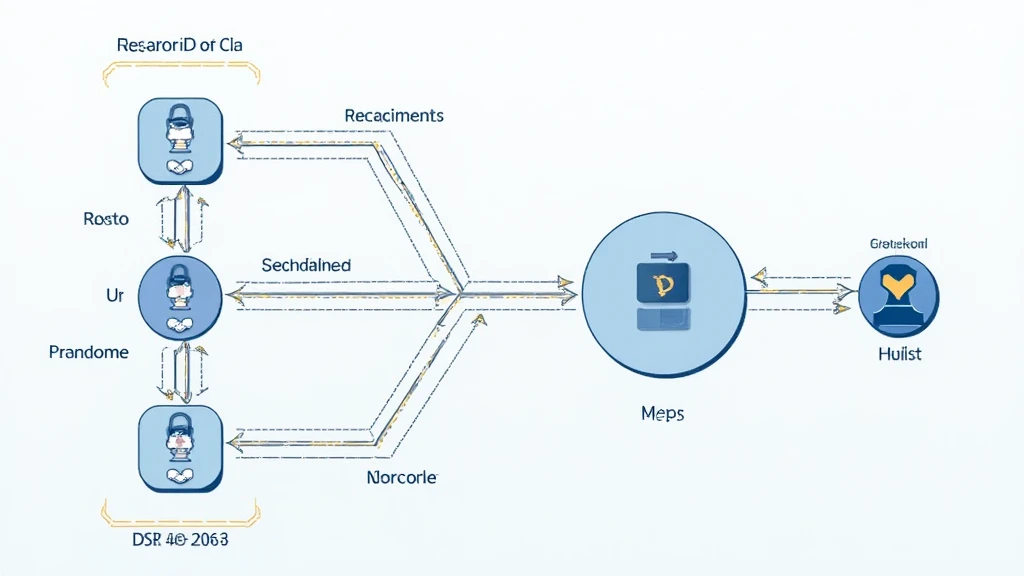

Think of cross-chain functionality like a currency exchange kiosk at the airport. When you’re traveling, you might need to exchange your dollars for euros. Similarly, digital assets on different blockchains require a mechanism to swap their value seamlessly. HIBT protocols aim to facilitate this exchange securely, allowing users to transfer assets across chains without the typical hurdles.

While HIBT decentralized exchange protocols strive for a seamless user experience, they face significant challenges, including trust and security. Imagine you’re at a small, unverified kiosk where the currency rates seem too good to be true. That’s how users must feel using unverified protocols without a strong security framework. It emphasizes the need for audits and reliable standards in decentralized finance.

Implementing zero-knowledge proofs can be compared to asking someone about a product without revealing your identity. This tech ensures transactions are valid without exposing sensitive information, enhancing privacy. Successful deployment in HIBT decentralized exchange protocols could solidify user trust while bolstering security.

Countries like Singapore are pulling ahead with DeFi regulations that could reshape the landscape by 2025. Think about it like local traffic laws; they ensure safe commutes. A robust regulatory framework may assist platforms to establish which HIBT protocols meet necessary criteria, thereby reducing risks significantly. For example, PoS mechanisms show less energy consumption than their predecessors, making them a greener option as regulation tightens.

In conclusion, the future of decentralized exchange protocols, particularly HIBT, is ripe for exploration and innovation. As we adapt to the shifting regulatory landscape and technological advancements, let’s empower ourselves with knowledge. For those interested in securing their investments, downloading our toolkit could significantly reduce your risk.

For more insights, check out our cross-chain security white paper and explore security solutions on HIBT.

Disclaimer: This article does not constitute investment advice. Always consult with local regulatory bodies like MAS or SEC before making financial decisions. Utilizing hardware wallets like Ledger Nano X can reduce your risk of private key exposure by 70%.