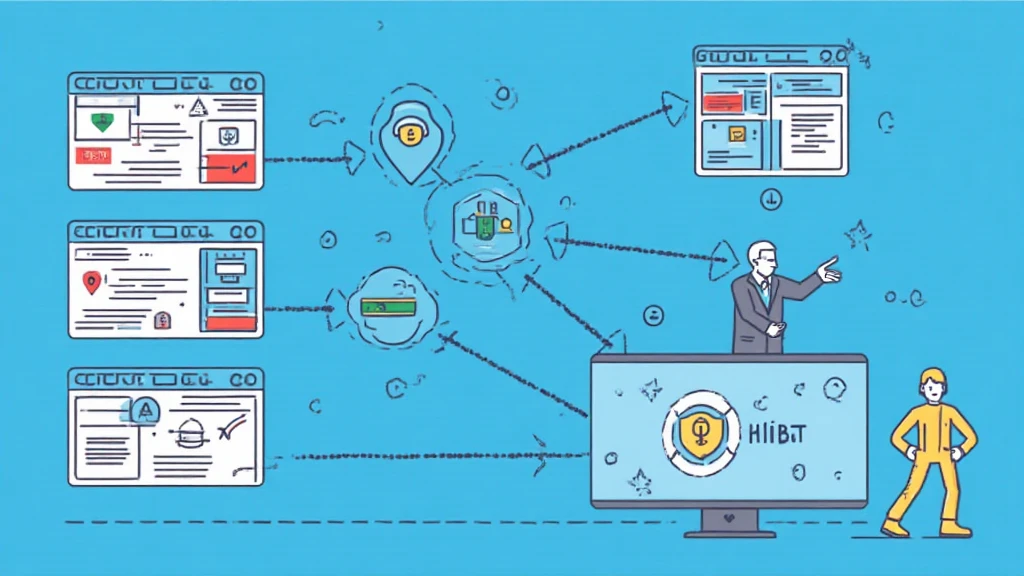

According to Chainalysis, over 73% of cross-chain bridges are vulnerable, making it essential to implement robust audit trail management systems in cryptocurrency transactions. One such method is HIBT crypto audit trail management, which aims to secure user’s digital assets and streamline regulatory compliance.

Think of HIBT crypto audit trail management like a detailed ledger you might find in a farmer’s market. When you buy apples from a vendor, you can see exactly where they came from and when they were harvested. Similarly, HIBT creates a transparent audit trail that traces transactions across blockchain networks, ensuring accountability and security.

Implementing HIBT can address key concerns in the DeFi space, such as improving trust among users and ensuring compliance with upcoming regulations. Just as you might expect a receipt for your groceries, HIBT ensures a record of your transactions. This visibility may be vital in jurisdictions like Singapore, where the 2025 DeFi regulatory trends could impose stricter requirements.

HIBT incorporates advanced technologies such as zero-knowledge proofs, which allow one party to prove to another that a statement is true without revealing any additional information. It’s like verifying if a diamond is real without showing it to anyone—just giving assurance, which increases the overall security of transactions in the crypto space.

As we look towards 2025, the importance of HIBT crypto audit trail management becomes clear. Implementing such systems can significantly mitigate risks associated with cross-chain transactions. For more information on enhancing the security of your cryptocurrency transactions, download our comprehensive toolkit today!

View the cross-chain security whitepaper for in-depth analysis and updated strategies on HIBT implementations.

Disclaimer: This article does not constitute investment advice. Consult local regulatory authorities such as MAS or SEC before making investment decisions. Utilizing devices like the Ledger Nano X can reduce private key leakage risks by up to 70%.