In today’s digital age, businesses are continually looking to innovate and adapt to changing consumer behaviors. One of the most significant shifts in recent years has been the rise of cryptocurrencies as a viable payment option. Accepting crypto payments opens up new avenues for businesses, enabling them to engage with tech-savvy customers and enhance their market reach.

Understanding the Landscape: Why Accept Cryptocurrency Payments?

As cryptocurrencies gain traction, understanding the landscape becomes crucial for businesses contemplating accepting crypto payments. The evolution of cryptocurrency dates back to Bitcoin’s inception in 2009, and since then, the market has expanded exponentially. This digital currency revolution has led to increased interest from consumers and businesses alike.

The Rise of Cryptocurrency Adoption

Cryptocurrencies have witnessed unprecedented growth, thanks to technological advancements and rising interest from both individuals and institutions.

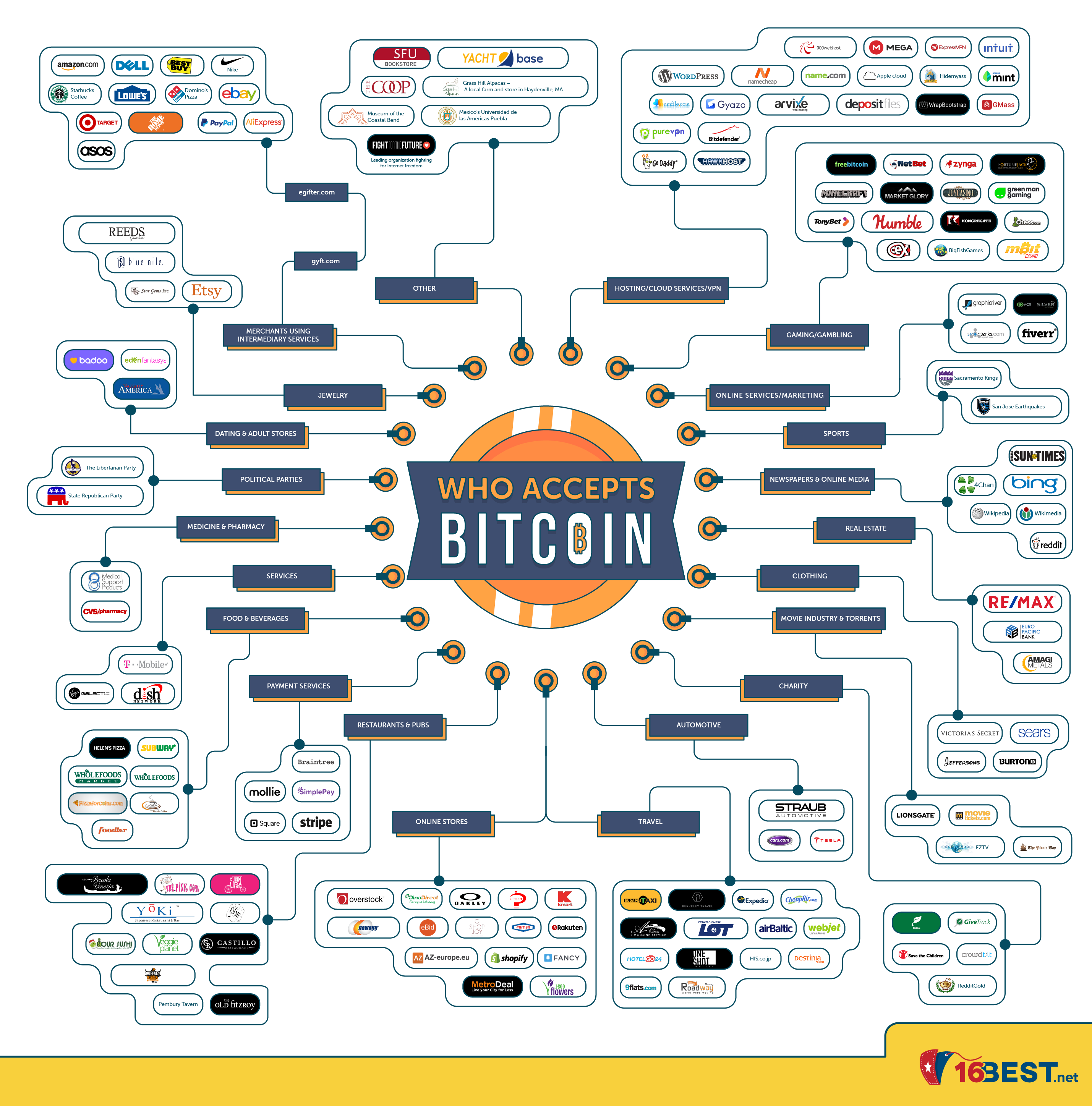

The mainstream acceptance of Bitcoin and other altcoins is evident in various sectors, including e-commerce, gaming, and even real estate. As more businesses embrace this technology, it is imperative for others to consider how accepting crypto payments can position them favorably in an increasingly competitive marketplace.

Another factor driving cryptocurrency adoption is the growing number of users engaging with blockchain technology. The decentralized nature of cryptocurrencies offers several advantages over traditional financial systems, such as reduced transaction fees and faster processing times. Furthermore, the ability to bypass intermediaries aligns perfectly with the desires of modern consumers who prioritize efficiency and autonomy in their transactions.

The Potential Market Reach

Accepting crypto payments can help businesses tap into an emerging demographic—the crypto enthusiasts and early adopters. This group often comprises young, tech-savvy individuals who prefer to utilize cryptocurrencies for their transactions due to perceived benefits like investment potential, privacy, and security.

Additionally, expanding market reach through crypto payments can also attract international customers who may face challenges with traditional banking services. By providing a seamless way for global customers to transact, businesses can diversify their revenue streams and foster loyalty among varying consumer bases.

The Cultural Shift Towards Digital Finance

As the world moves towards digital finance, many consumers are becoming disillusioned with conventional banking systems. Increased awareness around issues like inflation, economic instability, and data privacy breaches has spurred interest in alternative forms of currency.

By aligning themselves with this cultural shift, businesses that accept crypto payments can demonstrate their commitment to innovation and customer empowerment. This can ultimately translate into enhanced brand recognition and loyalty, as customers gravitate towards companies that resonate with their values and preferences.

Benefits and Drawbacks of Integrating Crypto Payment Systems

While the advantages of accepting crypto payments are compelling, it is essential for businesses to weigh the potential drawbacks before fully committing to this integration. Understanding the complete picture allows for informed decision-making and risk management.

Advantages of Accepting Crypto Payments

One of the primary benefits of accepting crypto payments is the reduction in transaction fees. Traditional payment methods, like credit cards, often come with hefty processing fees, which can eat into profit margins. In contrast, cryptocurrency transactions typically incur lower fees, allowing businesses to keep more of their earnings.

Another advantage is the speed of transactions. Crypto payments can often be processed in minutes, regardless of geographic location. This rapidity is particularly beneficial for businesses with international customers who may experience delays when using traditional banking systems.

Moreover, accepting crypto payments can help businesses stand out in a crowded market. By positioning themselves as forward-thinking and innovative, companies can attract customers who value modern payment solutions. This differentiation can lead to increased sales and new customer acquisition.

Potential Drawbacks of Implementing Crypto Payments

Despite the numerous benefits, there are downsides to consider. Cryptocurrency markets are notoriously volatile, with prices fluctuating dramatically within short periods. For businesses, this unpredictability can present challenges regarding pricing strategies and cash flow management.

Another concern is the regulatory landscape surrounding cryptocurrencies, which is still evolving. Depending on the jurisdiction, businesses may face compliance challenges or legal liabilities when handling crypto transactions. Staying abreast of these regulations is vital to avoid penalties and ensure smooth operations.

Lastly, customer education is a critical aspect of integrating crypto payments. Many consumers may not be familiar with how cryptocurrencies work, and merchants will need to invest time and resources in educating their customer base. Without sufficient knowledge, customers may hesitate to make purchases using cryptocurrency.

Key Considerations Before Enabling Crypto Payments for Your Business

Before adopting crypto payment systems, businesses must conduct thorough research and planning. Several key considerations should inform the decision-making process to ensure successful implementation.

Assessing Compatibility with Existing Payment Systems

Businesses should evaluate how well crypto payment systems can integrate with their existing infrastructure. This includes analyzing point-of-sale systems, e-commerce platforms, and accounting software to determine compatibility.

Understanding the technical requirements for integrating crypto payments will help set realistic expectations and timelines. Companies may need to collaborate closely with payment processors or developers to ensure a smooth transition.

Evaluating Customer Demand for Crypto Payments

Conducting market research to gauge customer interest in crypto payments is essential. Businesses should analyze their target audience’s demographics and preferences to identify whether there is a substantial demand for this payment method.

Surveys or feedback forms can provide valuable insights into consumer behavior, helping businesses make informed decisions about whether to proceed with accepting crypto payments. Engaging directly with customers fosters trust and demonstrates a commitment to meeting their needs.

Developing a Comprehensive Risk Management Strategy

To mitigate the risks associated with crypto payments, businesses should establish a robust risk management framework. This involves identifying potential vulnerabilities related to volatility, fraud, and regulatory compliance.

Implementing safeguards, such as price-locking mechanisms and stringent security protocols, can significantly reduce exposure to unforeseen risks. Additionally, businesses should regularly review and update their risk management strategies to adapt to the rapidly evolving landscape of cryptocurrency.

Choosing the Right Crypto Payment Processor: A Comparative Analysis

Selecting the appropriate crypto payment processor is crucial for businesses aiming to implement efficient and secure crypto payment systems. With numerous options available, conducting a comparative analysis helps identify the best fit for specific business needs.

Factors to Consider When Evaluating Payment Processors

When choosing a crypto payment processor, businesses should consider several factors, such as transaction fees, supported cryptocurrencies, and user experience. Each processor may have different fee structures, and selecting one with competitive rates can significantly impact profitability.

Additionally, businesses should assess the range of cryptocurrencies supported by each processor. Depending on the customer base, some businesses may prefer processors that support a wider variety of coins, while others may focus solely on popular currencies like Bitcoin and Ethereum.

User experience is another vital factor. A seamless, easy-to-navigate interface enhances customer satisfaction and encourages repeat transactions. Therefore, businesses should prioritize processors known for providing intuitive user experiences, both for customers and merchants.

Popular Crypto Payment Processors: A Comparative Overview

| Processor Name | Transaction Fees | Supported Currencies | User Experience Rating |

|---|---|---|---|

| BitPay | 1% | Bitcoin, Bitcoin Cash | High |

| Coinbase Commerce | 0% (for basic plan) | Bitcoin, Ethereum | Medium |

| CoinGate | 1% | Bitcoin, Litecoin, Ethereum | High |

| Blockonomics | 0% | Bitcoin | Medium |

Each processor has its strengths and weaknesses, making it critical for businesses to align their objectives with the offerings of each provider.

Comparing Integration Capabilities

Integration capabilities should also play a pivotal role in the selection process. Some processors offer plugins for popular e-commerce platforms like Shopify or WooCommerce, simplifying the setup process for online retailers. Others may provide APIs for custom integrations, allowing businesses to tailor their crypto payment solutions according to their unique needs.

Evaluating integration processes across different payment processors can save both time and costs during implementation. Businesses should seek out processors offering comprehensive documentation and dedicated support to facilitate a smooth integration experience.

Implementation Strategies: A Step-by-Step Guide to Accepting Crypto

Once the decision has been made to accept cryptocurrency payments, businesses must strategize for effective implementation. Following a structured approach can streamline the process and enhance overall success.

Step 1: Research and Select the Appropriate Processor

Begin the implementation process by conducting thorough research to select the right crypto payment processor based on your business’s needs and goals. Engage with multiple providers, gather information, and compare their features, fees, and integration capabilities.

Ensure that the chosen processor aligns with your existing workflows and adheres to security standards necessary for safeguarding your transactions.

Step 2: Modify Financial Infrastructure

After selecting a payment processor, modify your financial infrastructure accordingly. This may involve updating accounting software to accommodate cryptocurrency transactions, ensuring accurate tracking of revenue and expenses.

If applicable, prepare your team to handle crypto transactions effectively. Training staff on how to use the payment processor interface, manage exchanges, and report tax obligations will create a more streamlined experience for both employees and customers.

Step 3: Launch Marketing Campaigns

Communicate your new payment option to existing and potential customers through targeted marketing campaigns. Utilize social media, email newsletters, and your website to inform customers about the introduction of cryptocurrency payments.

Highlight the benefits of using crypto, such as reduced fees and enhanced security, to encourage uptake among hesitant customers. Building excitement around this innovation can boost engagement and drive sales as you launch your new payment system.

Step 4: Monitor Performance and Gather Feedback

Once your crypto payment system is live, continuously monitor its performance. Track important metrics such as transaction volume, customer satisfaction, and overall sales growth to evaluate the effectiveness of your implementation.

Gathering customer feedback is crucial for understanding their experiences and addressing any concerns they may have. Use surveys or direct outreach to solicit input, and use this information to refine your strategy as needed.

Navigating Regulatory Compliance and Security Best Practices for Crypto Payments

As regulations surrounding cryptocurrencies continue to evolve globally, businesses must remain vigilant in navigating compliance requirements. Establishing solid security measures is equally important to protect against fraud and cyber threats.

Understanding Regulatory Challenges

Compliance with local and international regulations is paramount for businesses accepting crypto payments. Regulations may vary significantly across jurisdictions, so it’s vital to research the laws pertaining to cryptocurrencies in your operating region.

Areas of focus may include anti-money laundering (AML) and know-your-customer (KYC) regulations, which require businesses to verify customer identities and monitor transactions for suspicious activity. Non-compliance can lead to severe penalties, so staying updated on evolving laws is crucial.

Implementing Security Protocols

Security should be a top priority when integrating crypto payments. Employing robust security protocols can help safeguard your business from potential cyber threats that accompany accepting digital currencies.

Utilizing encryption technologies, two-factor authentication, and secure wallets can significantly enhance security. Regularly updating software and conducting vulnerability assessments also ensure that your payment systems remain resilient against emerging threats.

Educating Employees on Security Awareness

Educating employees about best practices for maintaining security is critical. Conduct training sessions focused on identifying common cyber threats, safe internet browsing habits, and recognizing phishing attempts.

Creating a culture of security awareness within your organization can empower employees to be proactive in protecting sensitive information. This vigilance can significantly contribute to safeguarding your business’s assets and reputation.

Conclusion

Accepting crypto payments presents an exciting opportunity for businesses to adapt to the evolving landscape of commerce. With the potential for reduced transaction fees, faster processing times, and increased market reach, integrating cryptocurrency can provide a competitive advantage. However, businesses must carefully consider the benefits and drawbacks before moving forward. By assessing compatibility, evaluating customer demand, and developing comprehensive strategies, organizations can navigate the complexities of implementing crypto payment systems. Ultimately, with proper preparation, education, and adherence to regulatory standards, businesses can successfully embrace this innovative payment solution.