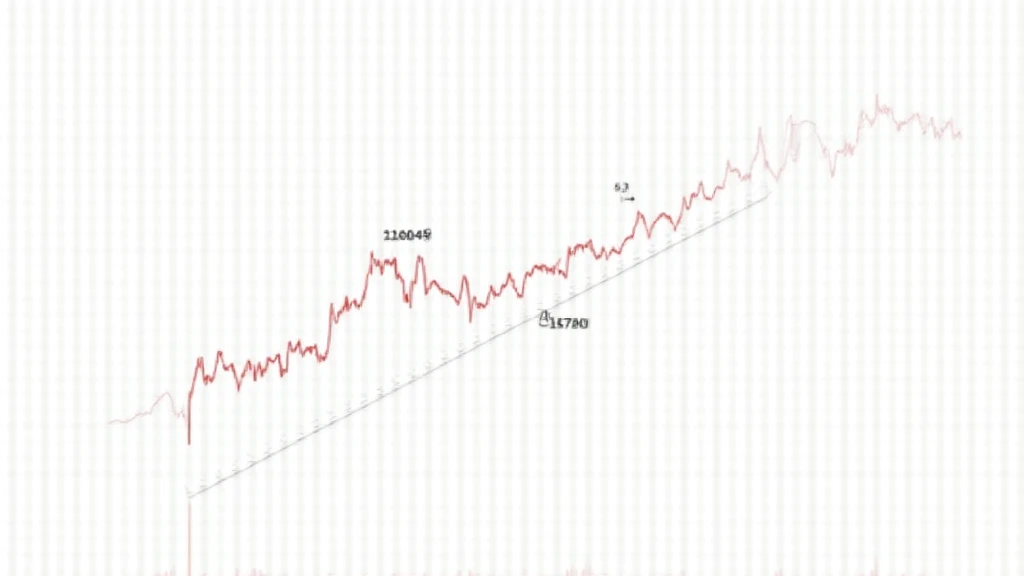

As the global interest in cryptocurrencies surges, the value of Bitcoin continuously evolves. In 2024 alone, over $4.1 billion was lost to DeFi hacks, prompting users to seek safer alternatives for their investments. This raises an important question: how do trends in the Bitcoin to SGD market reflect overall crypto health? This article offers crucial insights for both novice and seasoned investors looking to make informed decisions.

The Bitcoin price in Singaporean Dollars (SGD) is influenced by various global and local factors. Here are critical elements to consider:

- Market Demand: Increasing adoption of Bitcoin among Singaporeans contributes to its price.

- Regulatory Environment: New regulations can significantly impact market sentiment.

- Global Economic Trends: Events such as inflation rates and economic stability affect Bitcoin’s valuation.

Data from CoinGecko shows that Singapore’s crypto market has grown by over 65% since 2020, reflecting heightened interest from local investors.

While Bitcoin remains the dominant player, local altcoins are gaining traction. Consider the following:

- Local Innovation: Singapore-based altcoins like Tether and VeChain offer unique solutions tailored to the Southeast Asian market.

- Investment Opportunities: Diversifying into altcoins may yield higher returns for keen investors.

- Market Volatility: Altcoins typically exhibit more volatility compared to Bitcoin, posing both risks and rewards.

According to a 2025 industry report, altcoins are projected to capture a 30% market share in the Asian region.

Investors are encouraged to use advanced trading tools and resources for better insights:

- Real-time Analytics Platforms: Tools like TradingView provide up-to-date market analytics.

- Secure Wallets: Keeping assets in wallets such as Ledger Nano X reduces hacks significantly.

- News Aggregators: Following platforms like hibt.com helps investors stay informed about market trends.

Looking ahead, several trends are poised to shape the Bitcoin landscape in Singapore:

- Increased Institutional Adoption: Major financial institutions are beginning to integrate Bitcoin into their portfolios.

- Technological Advancements: Innovations in blockchain technology will lead to improved transaction speeds and security.

- Investor Education: As literacy in cryptocurrency increases, more individuals will enter the market.

Among the most promising insights, a recent study predicted that by 2025, Bitcoin could outperform traditional assets, riding on the wave of increased digital currency acceptance.

As the crypto landscape evolves, understanding Bitcoin to SGD market insights is vital for navigating your investment journey. By acknowledging factors like market demand, regulatory implications, and local altcoin growth, investors can make informed choices. For those just starting, tools and resources can facilitate a safer investment experience. Always remember that investing in cryptocurrency comes with risks, so consulting with local regulators is advisable before making significant financial decisions. For more insights on navigating the crypto world, visit cryptonewscash.