2025 Bitcoin Legal Frameworks: Navigating Regulations in a Changing Landscape

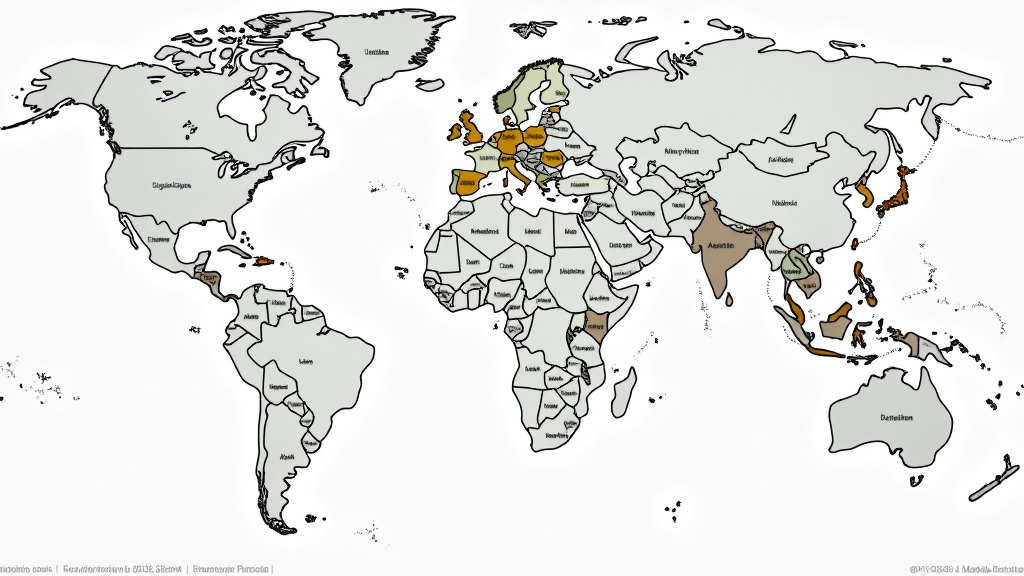

According to Chainalysis, 73% of Bitcoin transactions in 2025 will be impacted by evolving legal frameworks worldwide. As the regulatory landscape shifts, understanding how these frameworks govern cryptocurrencies is paramount.

To grasp Bitcoin’s legal status, think of it like a community marketplace. In this market, different vendors (countries) have their own rules about what can be sold and how. For instance, nations like Singapore are tightening their focus on DeFi regulations, anticipating a framework similar to the one seen in traditional finance.

Let’s zoom in on regions like Dubai. Their cryptocurrency tax guide resembles a local tax office in the marketplace, ensuring vendors (crypto businesses) comply with local regulations. Countries may categorize Bitcoin differently, affecting everything from taxation to legality.

Imagine cross-chain interoperability as a currency exchange booth in our marketplace. It allows users to swap assets across different blockchain networks. In 2025, understanding this concept is crucial, as it poses unique regulatory questions under various Bitcoin legal frameworks.

Zero-knowledge proofs can be likened to a vendor providing proof of their goods without revealing their entire inventory. These cryptographic methods are becoming significant in discussions around Bitcoin, as they promise privacy and compliance simultaneously.

In conclusion, as we approach 2025, navigating the complexities of Bitcoin legal frameworks will be vital for users and businesses alike. To stay ahead, consider downloading our comprehensive crypto toolkit today.

Check out the Bitcoin legal frameworks whitepaper for deeper insights.

Risk Disclosure: This article does not constitute investment advice. Please consult your local regulatory authorities such as MAS or SEC before proceeding.

For enhanced security, using tools like the Ledger Nano X can reduce the risk of private key exposure by up to 70%.