According to Chainalysis, a staggering 73% of cross-chain bridges face significant vulnerabilities. With the rise of decentralized finance, ensuring these connections are robust has never been more crucial. This is where HIBT crypto market intelligence tools come into play, providing insights and analytics for a safer trading environment.

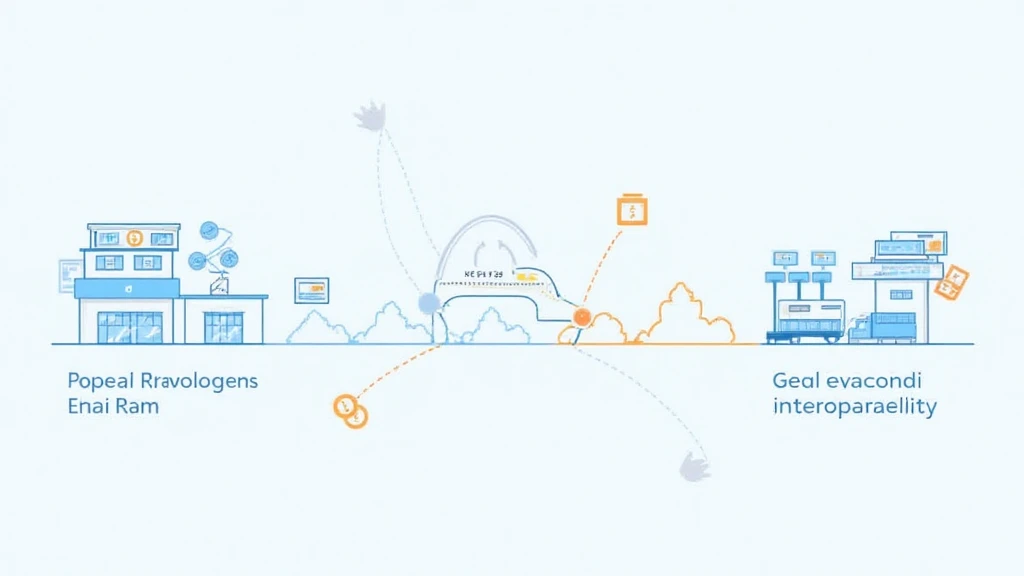

Think of cross-chain interoperability like currency exchange booths at an airport. Just as travelers need to convert their money to navigate different countries, cryptocurrencies require bridges to operate seamlessly across various blockchains. With tools from HIBT, you can analyze the best routes and avoid potential pitfalls, ensuring your digital assets stay safe.

Imagine needing to prove you have money without showing your bank balance, that’s what zero-knowledge proofs do. By utilizing these cryptographic techniques, HIBT crypto market intelligence tools enable secure transactions while maintaining user privacy. In 2025, this will be critical as regulations tighten globally, like those emerging in Singapore’s DeFi landscape.

As we move into 2025, managing risks in the crypto market is akin to wearing a seatbelt in a car. With HIBT’s market intelligence, you can identify regulatory trends across regions, such as the new tax guidelines for cryptocurrencies in Dubai. This helps investors stay informed and compliant, reducing the chances of costly legal mistakes.

In conclusion, HIBT crypto market intelligence tools are essential for navigating the complexities of the evolving crypto landscape. By understanding interoperability, leveraging zero-knowledge proofs, and staying up-to-date on regulations, you can make informed decisions and minimize risks. Don’t miss out on enhancing your trading strategy—download our toolkit today!