Understanding Cryptocurrency Payment Reconciliation

According to Chainalysis 2025 data, an alarming 73% of cross-chain bridges exhibit vulnerabilities that can lead to significant financial losses. This issue highlights the necessity for robust cryptocurrency payment reconciliation strategies to enhance security and efficiency in transactions.

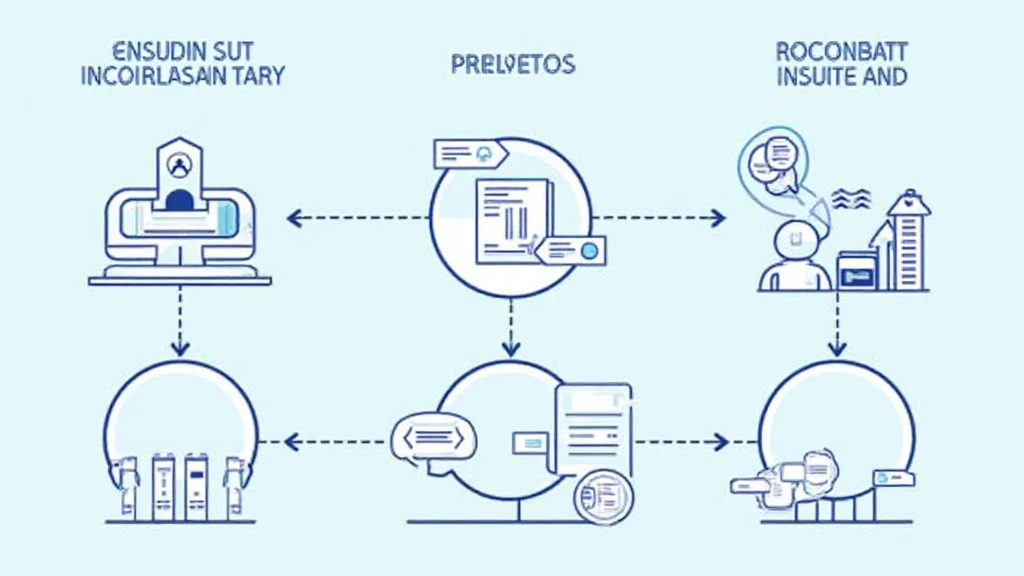

Think of cryptocurrency payment reconciliation as a sorting system at a bustling market. Just as vendors need to tally their sales accurately at the end of the day, businesses use reconciliation to ensure all transactions align with their financial records. It verifies that the amount received matches what was recorded, safeguarding against errors or fraud.

2398″>2/”>2532“>Cross-chain interoperability is like a currency exchange booth. For example, if someone wants to convert their Bitcoin into Ethereum, the process needs to be seamless and transparent. Payment reconciliation ensures that this exchange process is clear, verified, and accurate, thus preventing any financial discrepancies.

Zero-knowledge proofs can be likened to a secret handshake. You can prove you know a secret without revealing the secret itself. In payment reconciliation, these proofs enhance privacy and security. By implementing zero-knowledge proofs, businesses can validate their transactions without exposing sensitive details, fostering trust among users.

As we look towards 2025, the Singapore DeFi regulation trends will increasingly focus on enhancing transparency and security through effective payment reconciliation strategies. With significant regulatory considerations, companies must adapt their practices to comply with local laws while ensuring their cryptocurrency payment systems are secure and efficient.

In summary, cryptocurrency payment reconciliation is essential for maintaining the integrity of financial transactions in the evolving digital landscape. As businesses navigate through cross-chain interactions and compliance with regulations like those in Singapore, employing robust reconciliation methods becomes paramount.

Don’t leave your funds vulnerable. Download our Toolkit today to enhance your transaction security!