Understanding HIBT Bitcoin Mining Profitability Trends

According to Chainalysis data from 2025, approximately 73% of firms involved in Bitcoin mining are struggling to maintain profitability due to rising energy costs and regulatory changes. This article examines HIBT Bitcoin mining profitability, offering insight into the trends that shape the mining landscape.

Just like running a lemonade stand, where you need to consider ingredient costs, location, and competition, Bitcoin mining profitability is influenced by several key factors. Energy prices, mining hardware efficiency, and network difficulty play pivotal roles. For instance, if electricity prices skyrocket, it’s similar to the cost of lemons rising, squeezing your profit margins.

Absolutely! The location of your mining operation can significantly impact your profitability. Think of a miner in a country with high energy costs compared to one in a region with abundant renewable resources—it’s like selling ice in a city versus in the desert. Regions with favorable energy regulations, like Dubai’s burgeoning crypto-friendly environment, can provide a huge boost to miners’ bottom lines.

Imagine upgrading from a manual pumpkin-carving knife to a state-of-the-art electric saw. Technological advancements in mining hardware and software solutions can greatly enhance efficiency and profitability. Newer generation ASIC miners consume less electricity while delivering higher hash rates, making investments in the latest tech essential for remaining competitive.

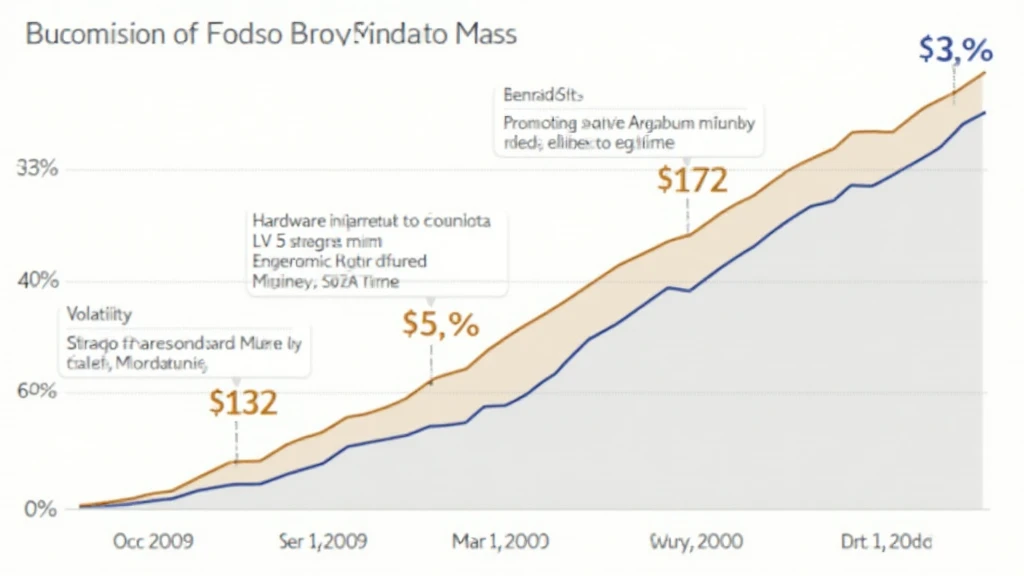

Market volatility acts like a roller coaster—one moment you’re soaring high, and the next, you’re plunging low. Bitcoin’s price fluctuations can directly affect mining decisions. If prices drop significantly, miners might find that their costs exceed their returns, prompting them to either quit or hold on for better days. Predicting these trends is crucial for maintaining HIBT Bitcoin mining profitability.

In conclusion, understanding the nuances of HIBT Bitcoin mining profitability is essential for both newcomers and seasoned miners. While the landscape is challenging, utilizing technology, strategic location choices, and staying informed about market trends can help navigate this complex arena.

For more insights, download our comprehensive tool package designed for crypto miners today!