With an estimated $4.1 billion lost to DeFi hacks in 2024 alone, the need for robust security measures in cryptocurrency networks has never been more critical. This article delves into cryptocurrency network segmentation, a strategy designed to enhance security and efficiency within blockchain ecosystems. Whether you’re a user or developer, understanding this concept could substantially bolster your digital asset protection efforts.

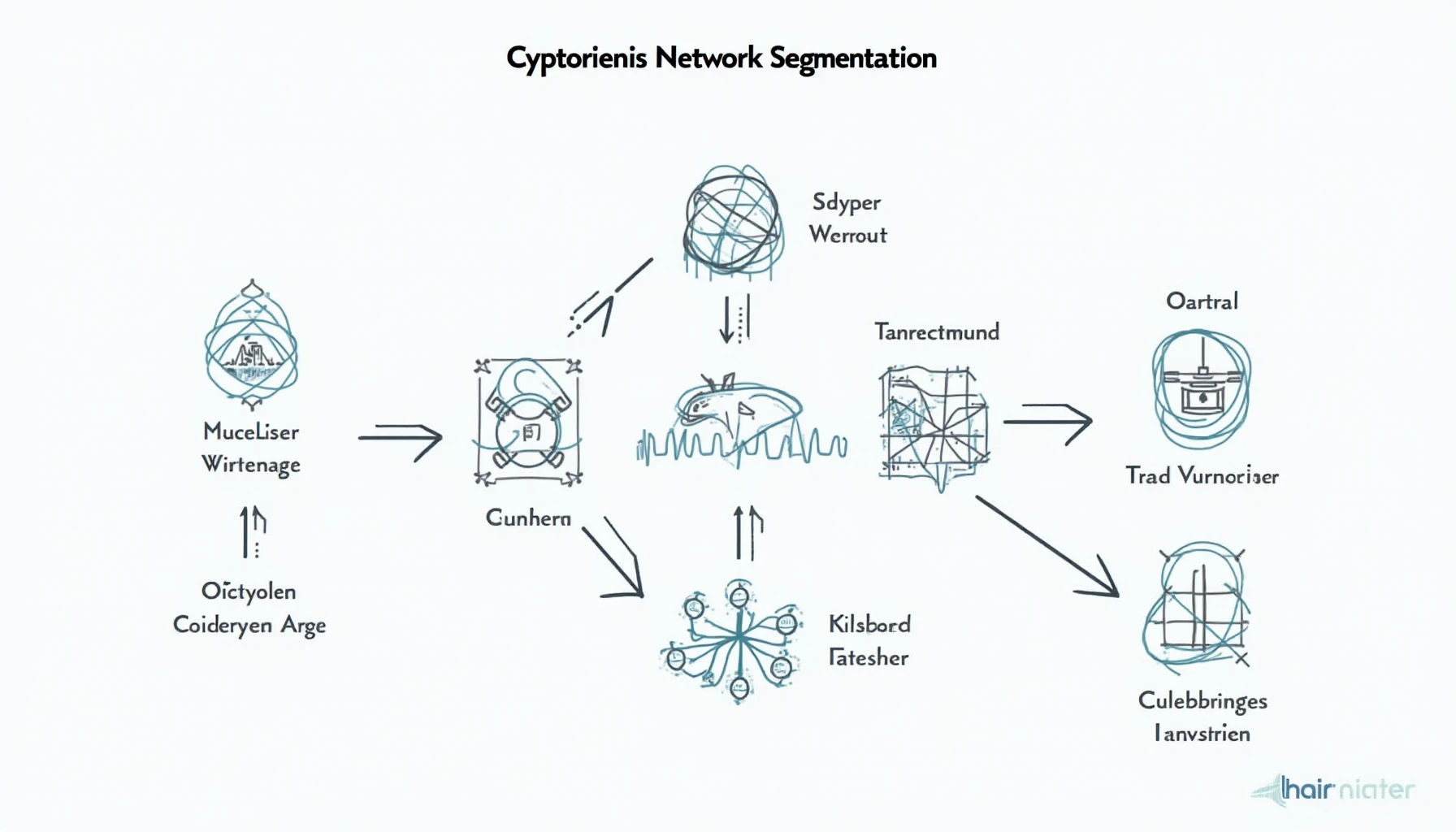

Network segmentation refers to the practice of splitting a computer network into multiple segments or sub-networks. Think of it like dividing a large safe into compartments for storing different valuables. By isolating cryptocurrency transactions to specific segments, networks can prevent unauthorized access and reduce the potential impact of security breaches.

Why is Segmentation Important?

The importance of network segmentation in cryptocurrencies is multifaceted:

- Enhanced Security: By isolating certain assets or transactions, the scope for attack is minimized, leading to fortification of tiêu chuẩn an ninh blockchain.

- Improved Performance: Segmentation can help in optimizing transaction speed by reducing congestion in the primary network.

- Better Compliance: Regulating user access and operations in segmented networks can ensure adherence to various regulatory requirements.

2449″>2543″>Blockchain protocols are pivotal in implementing effective network segmentation. While each blockchain may have unique features, many utilize protocols that emphasize scalability and security. For instance, Ethereum’s 2403″>2467″>2516″>Layer 2 solutions allow for transaction segregation, leading to improved performance without overly taxing the main blockchain.

Real-World Applications

Many cryptocurrency platforms adopt network segmentation to enhance their security protocols. By leveraging methods such as sharding, platforms can distribute data and processing across segments, mitigating risks while improving efficiency. For example, the recent trends among DeFi platforms have shown that those adopting segmented networks witness up to 25% greater transaction speeds compared to traditional models.

In Vietnam, the cryptocurrency market is burgeoning, with a user growth rate of approximately 37% in 2024. Understanding network segmentation is essential for Vietnamese users to ensure they navigate this expanding digital asset landscape securely. This growth creates a demand for enhanced blockchain security practices that align with local regulations.

What’s Next?

As cryptocurrencies continue to evolve, embracing network segmentation may serve as a best practice for future developments. It lays the groundwork for advanced security measures that safeguard digital assets while enabling seamless user experiences.

To wrap up, cryptocurrency network segmentation is not just a technical concept; it is a critical aspect of protecting digital assets in an increasingly complex landscape. By understanding and applying these principles, individuals and organizations can enhance the security of their blockchain interactions. As we look toward the future, staying updated on these practices will be crucial for maintaining trust within the cryptocurrency ecosystem.