In today’s rapidly evolving financial landscape, B2B crypto transactions are emerging as a revolutionary method for businesses to conduct their operations. As more companies embrace blockchain technologies and digital currencies, understanding how these transactions can unlock new avenues for growth and efficiency becomes paramount. This blog post will delve into the intricacies of B2B crypto transactions, exploring not only the benefits they offer but also the risks involved, compliance challenges, and future implications for businesses around the globe.

Unlocking B2B Potential: Navigating the World of Crypto Transactions

The world of B2B transactions has traditionally been dominated by fiat currencies, credit cards, and electronic transfers. However, with the advent of cryptocurrency, businesses are beginning to explore alternative payment methods that promise lower transaction fees, faster processing times, and enhanced security. As we navigate through the complexities of B2B crypto transactions, it is essential first to comprehend what makes them so appealing.

Understanding B2B Crypto Transactions

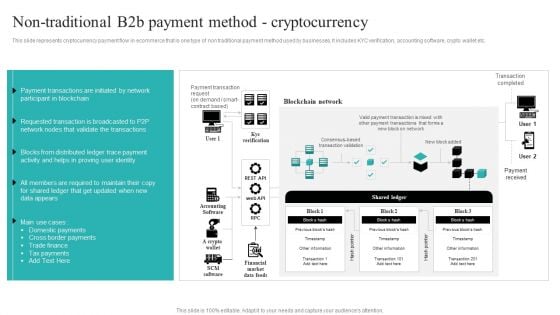

At its core, a B2B crypto transaction involves two businesses exchanging goods or services utilizing cryptocurrencies. This process can be significantly different from traditional payment systems due to the decentralized nature of cryptocurrencies and the underlying blockchain technology.

Cryptocurrencies enable real-time transactions without intermediaries, which generally leads to lower costs. Additionally, businesses can operate globally without worrying about currency conversions and associated fees.

Key Features of B2B Crypto Transactions

- Decentralization: Unlike traditional banking systems, cryptocurrencies function on decentralized networks, meaning no single entity controls the transactions. This aspect reduces the risk of fraud and enhances transparency.

- Speed: Transactions can be completed in minutes rather than days, especially when it comes to cross-border payments where traditional banking systems may involve multiple clearinghouses.

- Cost-Effectiveness: Transaction fees for Bitcoin or Ethereum transfers, for example, often fall significantly below those typically charged by banks or payment service providers.

- Security: Blockchain technology ensures that each transaction is recorded immutably on a public ledger. This offers an unprecedented level of security against tampering and fraud.

The Growing Trend of Crypto in Business

As businesses increasingly recognize the potential benefits of adopting cryptocurrencies, several have begun integrating them into their operational frameworks. The rise of e-commerce, global supply chains, and remote work scenarios has provided fertile ground for this transition. According to recent surveys, a substantial number of businesses are considering or actively implementing crypto payment solutions.

The growing acceptance of crypto can also be attributed to the increasing sophistication of digital wallets and payment platforms, making it easier for businesses to accept and manage cryptocurrencies. This trend presents new opportunities for innovation and expansion that companies cannot afford to ignore.

Streamlining Business Operations: The Benefits of B2B Crypto Payments

With the mainstream adoption of cryptocurrencies, businesses are starting to realize that B2B crypto payments can streamline operations and increase efficiency. By eliminating intermediaries, cutting down transaction times, and reducing fees, companies can focus on what matters most — their core business functions.

Cost Reduction Through Lower Fees

The fees associated with traditional banking transactions can eat into profit margins significantly. For instance, cross-border payments often incur high fees due to currency conversion and intermediary bank charges.

By using cryptocurrencies, businesses can bypass these costly processes altogether. Table 1 below highlights the comparative transaction fees between traditional banking methods and cryptocurrency transactions.

| Payment Method | Average Transaction Fee |

|---|---|

| Traditional Bank Transfer | 2% – 5% |

| PayPal | 2.9% + $0.30 per transaction |

| Credit Card Payments | 1.5% – 3.5% |

| Cryptocurrency (e.g., Bitcoin) | 0.1% – 1% |

This cost-saving advantage can be particularly beneficial for small and medium enterprises (SMEs), allowing them to enhance their competitiveness.

Enhanced Transaction Speed

Traditional banking systems can impose time delays due to various verification and clearance processes. In contrast, B2B crypto transactions can be processed in just minutes, sometimes seconds, depending on network congestion.

This speed not only improves cash flow but also allows businesses to react swiftly to market changes and customer demands. Companies can make immediate payments to suppliers or complete transactions that require quick action.

Improved Transparency and Security

Blockchain technology provides a transparent view of all transactions since they are recorded on a public ledger. Each transaction can be easily traced, reducing the likelihood of fraud or disputes. Businesses can feel confident that their transactions occur securely without the fear of manipulation by third parties.

Moreover, smart contracts — self-executing contracts with the terms directly written into code — can automate numerous aspects of transactions, ensuring that both parties adhere to agreed-upon terms without the need for external enforcement.

Global Accessibility

One of the most compelling advantages of B2B crypto transactions is their global reach. Businesses are no longer limited by country borders or currency restrictions, thus facilitating smoother trade relationships across international lines.

With the simplicity of accepting cryptocurrencies, businesses can engage with partners and suppliers worldwide without the challenges posed by currency exchanges and international regulations. This development opens doors to new markets and revenue streams, providing significant growth potential.

Mitigating Risks and Ensuring Compliance in B2B Crypto Transactions

While the advantages of B2B crypto transactions are substantial, they entail certain risks and challenges that businesses must navigate. From regulatory concerns to the volatility of cryptocurrencies, understanding these risk factors is crucial to leveraging the potential of crypto payments effectively.

Regulatory Challenges

Cryptocurrency regulations vary widely across countries. Some jurisdictions have embraced crypto and created frameworks for its use, while others have imposed strict rules or outright bans.

Businesses engaging in B2B crypto transactions must be aware of the legal landscape in their operating regions. It is imperative to stay informed about licensing requirements, tax obligations, Anti-Money Laundering (AML) laws, and Know Your Customer (KYC) regulations to avoid potential pitfalls.

Volatility of Cryptocurrencies

Another critical risk factor is the inherent volatility associated with cryptocurrencies. Prices can fluctuate dramatically within a short period, resulting in potential losses if businesses hold assets in crypto.

To manage this risk, companies can adopt strategies such as converting crypto to stablecoins (cryptocurrencies pegged to stable assets like fiat currencies) immediately after transactions or implementing hedging strategies to protect against major price swings.

Security Threats

Despite the robust security features of blockchain technology, businesses are still vulnerable to cyberattacks, hacking incidents, and phishing schemes targeting cryptocurrency wallets.

It is vital for companies to adopt rigorous cybersecurity measures to protect their crypto holdings. This includes using secure wallets, implementing multi-factor authentication, and training employees on safe practices concerning crypto transactions.

Developing Robust Compliance Frameworks

To mitigate risks effectively, businesses should establish comprehensive compliance frameworks tailored to their particular circumstances. This might involve consulting legal experts specializing in cryptocurrency regulations and developing internal policies governing crypto transactions.

Investing in compliance not only protects a company’s reputation but also assures stakeholders and customers that the business prioritizes safety and legality in its dealings.

Choosing the Right Cryptocurrency and Platform for B2B Transactions

The selection of the right cryptocurrency and transaction platform is crucial for businesses looking to implement B2B crypto payments successfully. With thousands of cryptocurrencies available and numerous platforms offering transaction services, making informed choices can significantly impact operational efficiency and success.

Popular Cryptocurrencies for B2B Transactions

When considering which cryptocurrency to adopt for B2B transactions, it is essential to analyze the following popular options:

- Bitcoin: As the original cryptocurrency, Bitcoin enjoys widespread recognition and acceptance. Its established infrastructure makes it a reliable choice for transactional purposes.

- Ethereum: Known for its smart contract functionality, Ethereum allows businesses to automate agreements and transactions, enhancing operational capabilities.

- Stablecoins (e.g., USDC, Tether): Stablecoins are designed to maintain value stability relative to fiat currencies. They reduce exposure to volatility, making them attractive for businesses aiming for predictable transactions.

- Ripple (XRP): Ripple focuses on facilitating fast cross-border transactions and is favored by banks and financial institutions, which may benefit B2B transactions involving multinational entities.

Analyzing Transaction Platforms

Once a cryptocurrency is selected, businesses must choose the right platform to facilitate their B2B transactions. Some key criteria for evaluation include:

- Security Features: Ensure the platform employs robust security protocols, including cold storage options and encryption technology.

- Transaction Fees: Compare transaction fees across platforms to identify the most cost-effective options for your specific needs.

- Ease of Use: A user-friendly interface ensures seamless integration into existing business workflows and minimizes employee onboarding time.

- Customer Support: Reliable customer support can help resolve any issues quickly and efficiently, fostering confidence in using the platform.

Integration with Existing Systems

Before adopting a B2B crypto payment system, consider how it will integrate with your current operations. Compatibility with accounting software, ERP systems, and other business tools is paramount to ensure a smooth transition and overall effectiveness.

Consider conducting trials or pilot programs with select suppliers or partners to assess the functionality and efficiency of the chosen cryptocurrency and platform before full-scale implementation.

The Future of Finance: How Crypto is Reshaping B2B Payments

As we look towards the future of finance, it is clear that cryptocurrencies will play an increasingly significant role in reshaping B2B payments. The evolution of business practices and technological advancements will dictate how companies adapt and harness the power of crypto.

Increased Adoption Across Industries

As more businesses recognize the advantages of B2B crypto transactions, we can expect increased adoption across various sectors. Industries such as retail, manufacturing, and logistics will likely lead the charge, as the demand for faster, cost-effective payment methods continues to grow.

Furthermore, financial institutions are also exploring ways to integrate cryptocurrencies into existing systems, leading to a more streamlined approach to business transactions.

The Rise of Decentralized Finance (DeFi)

Decentralized finance (DeFi) is gaining traction, enabling businesses to access financial services without reliance on traditional intermediaries. DeFi platforms offer lending, borrowing, and trading functionalities powered by blockchain technology.

For B2B transactions, this means businesses can leverage DeFi protocols to optimize cash flow, improve liquidity, and explore innovative financing options without the constraints of conventional banking systems.

Enhanced Financial Inclusivity

The rise of cryptocurrencies and B2B crypto transactions could pave the way for enhanced financial inclusivity, particularly in underbanked regions. Businesses in emerging markets can participate in global trade without the barriers posed by traditional banking infrastructures.

This newfound accessibility can stimulate economic growth and development, allowing smaller businesses to compete on a more level playing field with larger enterprises.

The Importance of Education and Awareness

As the world of B2B crypto transactions continues to evolve, educating stakeholders—employees, suppliers, and consumers—about the benefits, risks, and best practices surrounding cryptocurrencies will be imperative.

Awareness and knowledge-sharing initiatives can foster acceptance and drive the successful integration of crypto solutions within businesses, ultimately shaping the future of B2B transactions.

Case Studies: Successful Implementation of B2B Crypto Transaction Strategies

Examining real-world examples of businesses that have successfully implemented B2B crypto transaction strategies offers invaluable insights into best practices and innovative approaches. Here, we will explore a few notable case studies that demonstrate the potential of cryptocurrencies in enhancing business operations.

Case Study: Overstock.com

Overstock.com, a leading online retailer, was among the first major companies to accept Bitcoin as a form of payment back in 2014. The company recognized early on that incorporating cryptocurrency payments could attract tech-savvy customers and differentiate itself from competitors.

By capitalizing on the growing interest in cryptocurrencies, Overstock has seen increased sales and consumer engagement. Their implementation of secure cryptocurrency payment gateways and the ability to convert Bitcoin to USD instantly has allowed them to minimize exposure to volatility while enhancing customer experience.

Case Study: Shopify

Shopify, a popular e-commerce platform, launched its integration with various cryptocurrency payment processors, enabling merchants to accept Bitcoin, Ethereum, and other cryptocurrencies seamlessly.

This move has empowered countless small and medium businesses to tap into the growing crypto market, allowing them to cater to a wider customer base and enhance their payment capabilities. The flexibility provided by Shopify’s crypto integration has proven advantageous for merchants, especially during peak seasons.

Case Study: Tesla

In early 2021, Tesla announced that it would begin accepting Bitcoin as a payment option for its electric vehicles. This bold move signaled a significant endorsement of cryptocurrencies by one of the most influential companies in the automotive industry.

Tesla’s decision not only showcased the potential for B2B transactions but also emphasized the importance of adaptability in a changing market landscape. By embracing crypto payments, Tesla positioned itself favorably among environmentally conscious consumers who value innovative technology.

Conclusion

In conclusion, B2B crypto transactions hold immense potential to redefine how businesses transact, offering myriad benefits such as cost reduction, improved transaction speed, and enhanced security. However, navigating the complexities of regulatory challenges and volatility requires diligent risk management. Selecting the right cryptocurrency and transaction platform is crucial for operational success, while the future of B2B payments appears promising as more companies adopt innovative solutions. Through education and awareness, organizations can better prepare for the transformative journey ahead in the world of crypto transactions.