Establishing a crypto startup comes with its own set of unique challenges, particularly regarding the legal structure for crypto startups. This legal framework is not simply about choosing a business entity but encompasses a multitude of regulatory requirements, intellectual property protections, fundraising strategies, and risk management considerations. As such, understanding these elements is critical for any entrepreneur looking to launch a successful venture in the burgeoning world of cryptocurrencies.

Introduction: Navigating the Legal Landscape for Crypto Startups

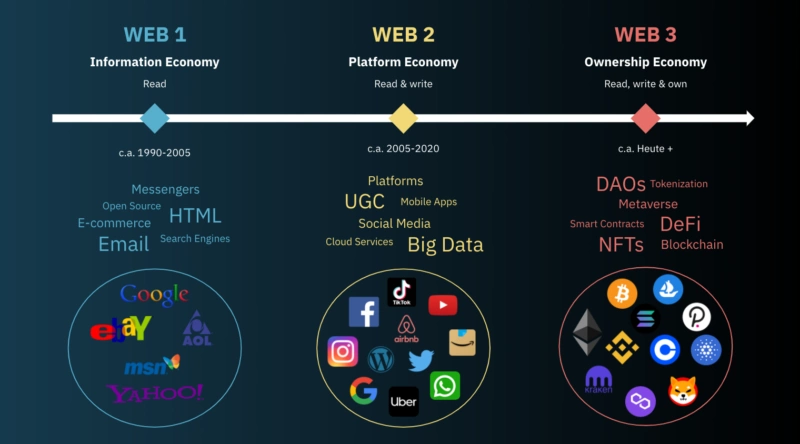

The rise of cryptocurrencies has revolutionized how we think about finance, technology, and entrepreneurship. As more individuals and businesses begin to explore opportunities in this space, the necessity for an appropriate legal framework becomes increasingly evident. Operating within the confines of existing laws while also being agile enough to adapt to new regulations is a balancing act that every crypto startup must master.

Defining the legal structure for a crypto startup is paramount to its success and sustainability. From traditional corporate formations like LLCs and corporations to innovative structures designed specifically for blockchain technology, entrepreneurs have a plethora of options available. However, each choice carries its own implications regarding liability, taxation, and compliance obligations.

Moreover, navigating the complex regulatory environment demands a thorough understanding of jurisdictional requirements. These can vary significantly from one country to another, making it essential for startups to conduct comprehensive legal due diligence before committing to any specific structure or operational strategy.

Choice of Legal Entity: Determining the Optimal Structure

The first step in establishing a legal structure for your crypto startup is selecting the right type of legal entity. This decision influences everything from liability exposure to tax treatment and governance.

Understanding Common Entity Structures

When considering the legal structure for a crypto startup, entrepreneurs typically choose between several common types of entities.

- Limited Liability Company (LLC): This structure offers flexible management and limited liability protection for its members. LLCs are generally taxed as pass-through entities, meaning profits are reported on individual tax returns, which can benefit startup founders.

- Corporation: Particularly popular among tech startups, corporations provide strong liability protection but come with more extensive regulatory requirements. C-Corps and S-Corps are two variants, each carrying different tax implications.

- Partnership: While partnerships allow for shared responsibilities and resources, they do not provide liability protection, making them less desirable for high-risk ventures like crypto startups.

Understanding these structures is crucial as it sets the foundation for the business’s operational model, affecting everything from investment opportunities to internal governance.

Jurisdictional Considerations in Entity Selection

Choosing the right jurisdiction can be as important as selecting the legal entity itself. Different countries offer unique benefits and drawbacks depending on their regulatory framework concerning cryptocurrencies.

- United States: The U.S. has a complex regulatory landscape, with various federal and state laws impacting crypto startups. Certain states, like Wyoming, have become attractive for crypto businesses due to favorable legislation and tax incentives.

- Singapore: Known for its regulatory clarity and supportive environment for fintech startups, Singapore offers numerous advantages, including low corporate taxes and a straightforward licensing process through its Monetary Authority.

- Malta: Often referred to as the “Blockchain Island,” Malta has enacted several laws to create a conducive environment for cryptocurrency companies, positioning itself as a global hub for blockchain business operations.

Entrepreneurs should evaluate the pros and cons of potential jurisdictions by contemplating both immediate and long-term business goals, alongside the evolving landscape of cryptocurrency regulation.

The Impact of Business Objectives on Entity Choice

Choosing a legal structure should align with the overarching mission and objectives of the startup. For instance, if the primary goal is to raise venture capital, establishing a corporation might be more advantageous due to its familiarity among investors.

Conversely, if the intention is to build a community-oriented platform with fewer regulatory burdens, a cooperative or LLC structure may empower more inclusive participation from stakeholders.

It’s essential for entrepreneurs to assess their long-term vision and understand how the chosen legal structure supports that vision, ensuring it fosters growth and innovation rather than hindrances.

Regulatory Compliance: Understanding Key Jurisdictional Requirements

Once the legal entity is established, the next layer of complexity involves adhering to the myriad of regulations that govern cryptocurrency operations. Regulatory compliance is vital for maintaining legitimacy and avoiding potentially costly penalties.

Cryptocurrency Regulations Overview

Regulations surrounding cryptocurrencies can differ vastly between jurisdictions, often leading to confusion among founders regarding what rules apply to them.

- Securities Laws: In many jurisdictions, certain tokens or coins may be classified as securities, requiring adherence to securities laws. Failure to comply can result in sanctions or legal action.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: Most countries require crypto exchanges and startups to have robust AML and KYC procedures in place to prevent illegal activities such as money laundering and fraud.

- Tax Compliance: Tax obligations in the crypto space can be convoluted, as transactions may be treated differently based on local laws. Understanding these tax implications is crucial for maintaining compliance and avoiding penalties.

Awareness of these regulations is imperative; all too often, startups overlook compliance until it becomes a significant hurdle that jeopardizes their operations.

Navigating Registration and Licensing Needs

Beyond simply understanding regulations, many jurisdictions require specific registrations or licenses to operate legally.

- Licensing Requirements: Countries such as the U.S. and Canada may mandate licenses for cryptocurrency exchanges, necessitating formal applications that demonstrate compliance with local laws.

- Reporting Obligations: Startups must also familiarize themselves with any ongoing reporting obligations that may arise post-registration. This includes regular financial disclosures and updates to regulatory bodies.

Failure to navigate these requirements effectively can lead to substantial delays in operations and even loss of license to operate.

International Regulations and Cross-Border Operations

For crypto startups looking to expand beyond their home jurisdiction, understanding international regulations becomes essential. Each country may impose its own set of rules regarding the legality of cryptocurrencies, trading practices, and consumer protections.

Startups must adopt a global compliance strategy to ensure they remain compliant while operating across borders. This often involves collaborating with local legal experts who can provide insight into the nuances of each jurisdiction’s requirements.

Navigating international regulations adds another layer of complexity, yet doing so is key for ambitious startups aiming to capitalize on global market opportunities.

Intellectual Property Protection: Safeguarding Crypto Startup Innovations

In the fast-paced world of cryptocurrencies, protecting intellectual property (IP) is paramount. With the rapid development of blockchain technologies and related innovations, crypto startups must take proactive steps to secure their inventions and ideas.

Types of Intellectual Property Applicable to Crypto Startups

Various forms of IP protection are relevant for crypto startups, including patents, trademarks, copyrights, and trade secrets.

- Patents: If a startup has developed a novel technology or system, applying for a patent can protect against unauthorized use. However, obtaining a patent can be time-consuming and costly, requiring a thorough understanding of what constitutes patentable subject matter in the crypto space.

- Trademarks: Establishing a trademark safeguards the brand identity of the startup, preventing competitors from using similar branding that could confuse consumers. It’s crucial to conduct proper searches to avoid infringement issues.

- Copyrights: For content-based startups, copyright registration protects creative works such as software code, white papers, articles, and educational materials.

Understanding the interplay between these various forms of IP protection helps startups design a comprehensive strategy to safeguard their innovations.

Challenges of Protecting Blockchain Innovations

Blockchain technology poses unique challenges regarding IP protection. Given its open-source nature, sharing developments and innovations while securing proprietary rights can be complex.

- Public Disclosure: Open-source projects often require public disclosure of code, which can complicate the ability to file for patents. Founders need to carefully consider how much information to share publicly versus what to keep confidential.

- International IP Laws: Different countries have distinct laws governing IP rights, complicating efforts to enforce protections globally. Startups planning to operate internationally must navigate these varied landscapes.

Engaging legal counsel experienced in blockchain technology can help mitigate these challenges and facilitate a cohesive IP strategy.

Developing an IP Strategy for Crypto Startups

Creating a robust IP strategy begins with identifying assets that warrant protection and determining the best mechanisms to secure those rights.

- Conducting an IP Audit: An IP audit serves as a baseline for assessing current protections and identifying areas of vulnerability. This process highlights opportunities for additional protection measures and informs strategic decisions.

- Educating Teams: Founders must educate their teams about IP rights and the importance of safeguarding innovations. This will create a culture of awareness and responsibility around IP matters.

- Leveraging Non-Disclosure Agreements (NDAs): NDAs are invaluable tools for protecting sensitive information during discussions with potential partners or investors. Having clear agreements in place mitigates risks associated with idea theft or misuse.

By proactively developing an IP strategy, crypto startups can position themselves competitively while safeguarding their innovations for future growth.

Fundraising and Investment Structures: Navigating Securities Laws

Securing funding is often one of the most challenging aspects of launching a crypto startup. With various investment structures available, understanding the nuances of securities laws is essential.

Traditional Funding Methods Versus Token Sales

Crypto startups have unique funding opportunities compared to traditional businesses, notably through Initial Coin Offerings (ICOs) and Security Token Offerings (STOs).

- ICOs: ICOs allow startups to raise capital by issuing tokens in exchange for cryptocurrencies. However, depending on the token’s characteristics, ICOs may fall under securities regulations, necessitating compliance.

- STOs: STOs are seen as a more compliant alternative to ICOs, as they issue security tokens that represent ownership in a company. This approach tends to attract institutional investors due to the regulatory safeguards involved.

Deciding between these funding strategies requires an understanding of investor sentiment and regulatory impact on the chosen model.

Complying with Securities Regulations

Regardless of the fundraising method chosen, compliance with securities laws is a critical consideration.

- Determining Token Classification: Founders must assess whether their tokens qualify as securities based on the Howey Test or other applicable criteria. Engaging legal counsel for this assessment can help mitigate legal risks.

- Filing Requirements: Depending on the classification, startups may need to file registration statements or seek exemptions with relevant regulatory agencies before proceeding.

- Investor Accreditation: Some jurisdictions require that only accredited investors participate in certain offerings, adding a further layer of complexity to fundraising efforts.

Following these compliance guidelines is crucial for avoiding legal pitfalls and gaining investor trust.

Alternative Investment Structures and Approaches

In addition to ICOs and STOs, crypto startups can explore alternative investment structures.

- Venture Capital Investment: Attracting venture capital can provide startups with not only funds but also valuable mentorship and connections. However, VCs tend to seek equity stakes, which may dilute founder control.

- Crowdfunding Platforms: Utilizing crowdfunding platforms designed for cryptocurrencies can offer access to larger audiences while complying with necessary regulations.

- Token Buybacks and Rebates: Structuring buybacks or rebate programs can incentivize participation from early investors and foster community engagement.

Exploring these various avenues equips crypto startups with diverse funding strategies that align with their operational models and growth trajectories.

Risk Mitigation and Due Diligence: Essential Legal Considerations

Starting a crypto venture entails inherent risks, making legal due diligence and risk mitigation crucial components of an effective strategy.

Identifying Potential Legal Risks

Crypto startups face numerous legal risks, from regulatory non-compliance to intellectual property disputes. Identifying these risks is the first step toward effective mitigation.

- Regulatory Risks: As discussed previously, failing to comply with laws can lead to severe consequences. Keeping abreast of regulatory changes in multiple jurisdictions is necessary for informed business decisions.

- Operational Risks: The inherently decentralized nature of cryptocurrencies can expose startups to vulnerabilities regarding data breaches and cyber threats. Implementing robust cybersecurity measures is essential.

- Market Volatility Risks: Cryptocurrencies are notoriously volatile, which can impact business operations and investment valuations. Establishing contingency plans for downturns is prudent.

By recognizing these potential risks, startups can develop strategies to minimize their likelihood and impact.

Conducting Thorough Due Diligence

Due diligence is a vital component of mitigating legal risks.

- Legal Audits: Regular legal audits can identify compliance gaps and ensure that operational practices align with applicable regulations. Engaging legal professionals for these audits provides additional assurance.

- Investor Due Diligence: For startups seeking external investments, conducting due diligence on potential investors ensures alignment with business goals and avoids conflicts down the line.

- Contractual Protections: Negotiating comprehensive contracts with vendors, partners, and employees can limit liability exposure and establish clear expectations.

A proactive approach to due diligence enhances overall operational resilience and positions startups favorably in times of uncertainty.

Building a Culture of Legal Awareness

Finally, fostering a culture of legal awareness throughout the organization is essential for effective risk management.

- Training Programs: Offering training sessions focused on legal compliance, privacy policies, and intellectual property rights empowers employees to recognize and address legal issues.

- Clear Communication Channels: Establishing open lines of communication encourages team members to voice concerns or questions about legal matters without fear of repercussions.

- Consulting with Legal Experts: Engaging legal advisors early in the decision-making process creates a collaborative environment where legal issues are addressed proactively rather than reactively.

By cultivating a culture of awareness, crypto startups can better navigate the legal landscape and minimize risks associated with compliance failures.

Conclusion

In summary, establishing a solid legal structure for crypto startups is a multifaceted endeavor encompassing various considerations ranging from entity selection to compliance with complex regulatory frameworks. Entrepreneurs must thoughtfully assess their business objectives, navigate intellectual property protections, and explore diverse fundraising avenues while implementing risk mitigation strategies. By approaching these components comprehensively, crypto startups can build a robust foundation for sustainable growth and innovation in the dynamic cryptocurrency landscape.