Using Excel to Record Mining Income and Expenses: A Comprehensive Guide

As cryptocurrency mining continues to gain traction, many miners are looking for effective ways to track their profits and expenses. According to Chainalysis 2025 data, about 73% of miners struggle with financial tracking, which can lead to unnecessary complexities. One viable solution in the digital age is using Excel to record mining income and expenses.

Mining can be likened to running a small business; just as a grocery store owner needs to keep track of sales and supplies, miners must monitor their income and expenditures. Proper documentation can help avoid potential tax issues and manage cash flow efficiently. Failing to track could lead to unpleasant surprises or losses down the road.

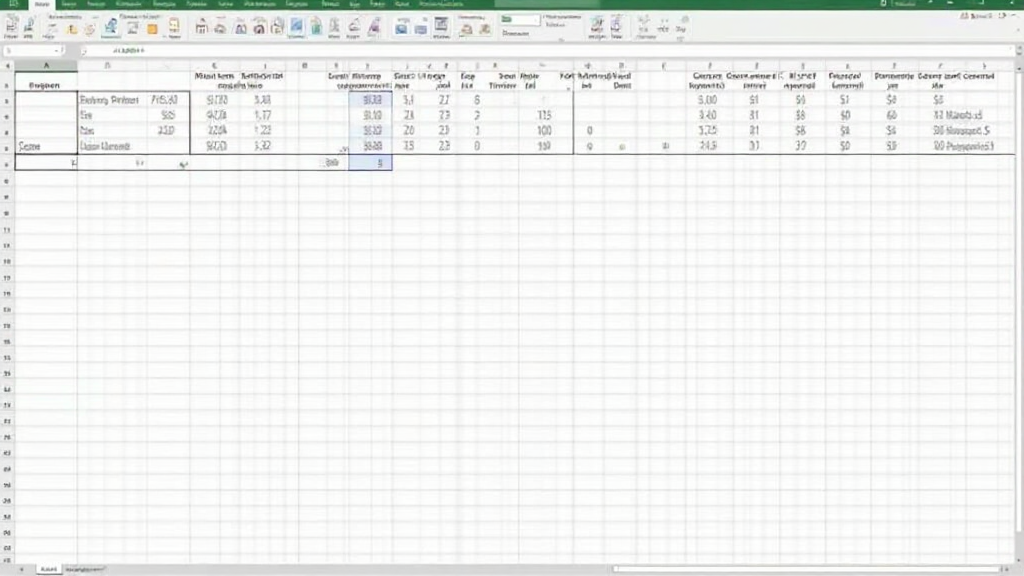

If you’re wondering how you can implement this into your mining routine, think of Excel as your digital notebook that organizes all transactions. You might have come across spreadsheets that seem intimidating, but they’re quite easy once you get started. Using Excel to record mining income and expenses helps maintain clarity and offers several benefits:

- Data organization: You can categorize income and expenses, making it easy to analyze your financial health.

- Readily accessible: Being able to reference and update your records wherever you are simplifies the process.

- Customization: Tailor your spreadsheets to fit your unique mining operations.

You may feel overwhelmed at the thought of starting a new spreadsheet, but it’s as easy as pie. To visualize it better, think of your spreadsheet like a cart at the market where you note down every item you buy:

1. Open Excel and create a new sheet.

2. Label columns such as Date, Income, Expense, and Notes.

3. Fill in your data each day, just as you would add new items to your cart.

Many miners overlook the importance of regular updates, comparing it to forgetting to write down expenses at the grocery until the end of the month. Remember, consistency is key. Also, be sure not to mix personal and mining finances, as this could muddy your insights.

For those in regions like Dubai, understanding tax implications on your mining income is crucial. Consult local regulations; for example, check the Dubai cryptocurrency tax guide for clarity.

By using Excel to record mining income and expenses, miners can gain control over their finances, ensuring a smoother and more profitable operation in this ever-changing market. For a practical start, download our toolkit which provides templates and guides to set up your own Excel sheet.

Disclaimer: This article is not investment advice; please consult with local regulatory authorities like MAS or SEC before engaging in financial activities.

Strengthen your cryptocurrency security! With the Ledger Nano X, you can minimize the risk of private key exposure by up to 70%.

If you’d like more insights into securing your investments or understanding crypto regulations, be sure to check out our resources.