In today’s fast-paced digital economy, cryptocurrency has emerged as a viable option for transactions. One of the most popular cryptocurrencies, Bitcoin, provides a unique way to process payments. If you’re seeking to expand your payment options or tap into the growing number of Bitcoin users, knowing how to invoice in Bitcoin is essential. This comprehensive guide will walk you through everything from setting up your wallet to complying with tax regulations.

Understanding Bitcoin Invoicing: A Comprehensive Guide

Bitcoin invoicing is not just about sending a request for payment; it’s a whole new approach to conducting business. As Bitcoin continues to gain traction, more businesses are considering how it can fit into their operations.

When it comes to invoicing, the primary goal is to ensure that both you and your client understand the terms of the transaction clearly. Bitcoin introduces a decentralized currency that operates independently of traditional banking systems. This characteristic presents unique benefits and challenges that you need to navigate.

What is Bitcoin Invoicing?

Bitcoin invoicing refers to creating an invoice that specifies the amount due in Bitcoin instead of conventional currencies. The invoice typically includes:

- The amount owed

- The Bitcoin address for payment

- Payment instructions

- Any applicable descriptions or services rendered

Unlike traditional invoicing, which relies heavily on banks and payment processors, Bitcoin transactions occur directly between parties. This peer-to-peer structure can streamline the payment process but also demands that both parties have a clear understanding of the Bitcoin ecosystem.

How Does Bitcoin Invoicing Work?

The mechanics behind Bitcoin invoicing involve generating unique addresses and QR codes for each transaction. When creating an invoice:

- You’ll generate a Bitcoin address for the recipient.

- Specify the amount required.

- Share the invoice with the client, typically via email or a dedicated invoicing app.

Once the client processes the payment, the transaction is recorded on the Bitcoin blockchain. The entire process is transparent, traceable, and secure, making it appealing for people who value privacy and security in financial transactions.

Advantages of Bitcoin Invoicing

There are several advantages to invoicing in Bitcoin, including:

- Lower Transaction Fees: Traditional banking systems often charge high fees for processing payments. Bitcoin can reduce these costs significantly, benefiting both parties.

- International Transactions Made Easy: Bitcoin transcends borders effortlessly, eliminating the complexities of currency conversion and international banking fees.

- Rapid Payments: Once the transaction is initiated, Bitcoin payments can be confirmed within minutes, speeding up the payment cycle.

In conclusion, Bitcoin invoicing is a significant innovation that offers numerous advantages over traditional methods. Understanding the intricacies of Bitcoin is critical to leveraging its full potential in your business.

Setting Up Your Bitcoin Wallet for Invoicing

Before you can begin invoicing in Bitcoin, you need a reliable Bitcoin wallet. This wallet serves as your gateway to buy, sell, and store Bitcoin securely. Choosing the right wallet is crucial for ensuring the safety of your funds and facilitating easy transactions.

Types of Bitcoin Wallets

There are several types of Bitcoin wallets available, each offering different features, security levels, and ease of use. The main categories include:

- Software Wallets: These wallets are applications installed on your computer or mobile device. They provide convenience and accessibility but may be vulnerable to malware and hacking.

- Hardware Wallets: Designed specifically for cryptocurrency storage, hardware wallets like Ledger and Trezor provide a high level of security by keeping your private keys offline.

- Web Wallets: Accessible through web browsers, these wallets offer ease of access and usability but come with risks related to online security.

- Paper Wallets: A less common method, paper wallets involve printing your public and private keys on a physical piece of paper. While highly secure from digital threats, paper wallets can be lost or damaged easily.

Setting Up Your Wallet

To set up your Bitcoin wallet, follow these steps:

- Choose the Right Kind of Wallet: Assess your needs—do you prioritize security or ease of access?

- Download or Purchase Your Wallet: If you opt for a software or hardware wallet, download or purchase it from a reputable provider.

- Create Your Wallet: Follow the setup instructions provided by the wallet application, including creating a strong password and backing up your recovery phrase.

- Secure Your Wallet: Enable two-factor authentication and ensure you understand the security measures necessary to keep your wallet safe.

Taking the time to set up your Bitcoin wallet properly ensures you can manage your invoices effectively and securely.

Best Wallets for Invoicing in Bitcoin

Not all wallets are created equal, especially when it comes to invoicing. Here’s a list of some of the best Bitcoin wallets suitable for handling invoices:

- Coinbase: Known for its user-friendly interface, Coinbase allows for easy buying, selling, and storing of Bitcoin while offering a dedicated invoicing feature.

- BitPay: Specifically designed for merchants, BitPay offers simple invoicing solutions along with payment processing tools allowing businesses to accept Bitcoin seamlessly.

- Blockchain.com Wallet: This wallet combines ease of use with advanced security features, making it a great option for both new and experienced users.

Investing your time in choosing the right wallet helps you streamline your invoicing process while ensuring a secure environment for your Bitcoin transactions.

Step-by-Step Guide to Creating Bitcoin Invoices

Creating Bitcoin invoices involves several steps, from addressing the nuances of your pricing model to the final digital delivery. With this guide, you’ll understand how to craft effective invoices tailored for Bitcoin transactions.

Gathering Necessary Information

Before proceeding to create an invoice, gather all relevant details. You should consider:

- Client Information: Name, address, and contact details of the client.

- Invoice Number: Unique identification for tracking purposes.

- Description of Services: Detailed breakdown of services provided, including hours worked and rates charged.

- Payment Terms: Clearly define how long the client has to pay and any late fees associated with overdue payments.

Having all this information at hand allows for seamless invoice creation and minimizes errors that could lead to delays in payment.

Using Invoicing Software

Many digital platforms simplify the process of creating Bitcoin invoices. Some popular invoicing software options include:

- QuickBooks: Offering robust support for various payment methods, including Bitcoin through integrated apps.

- FreshBooks: This cloud-based solution is intuitive and supports Bitcoin payments via third-party plugins.

- Xero: Known for its flexibility, Xero integrates with multiple payment gateways, including those specializing in Bitcoin transactions.

Once you’ve chosen your software, follow these general steps to create your invoice:

- Log in to Your Invoicing Software: Open the platform and select the option to create a new invoice.

- Input Client Details: Enter all the required client information accurately.

- Add Services Rendered: Include all relevant service descriptions, amounts, and any applicable taxes.

- Specify Payment Method: Choose “Bitcoin” as the payment option and add your Bitcoin address.

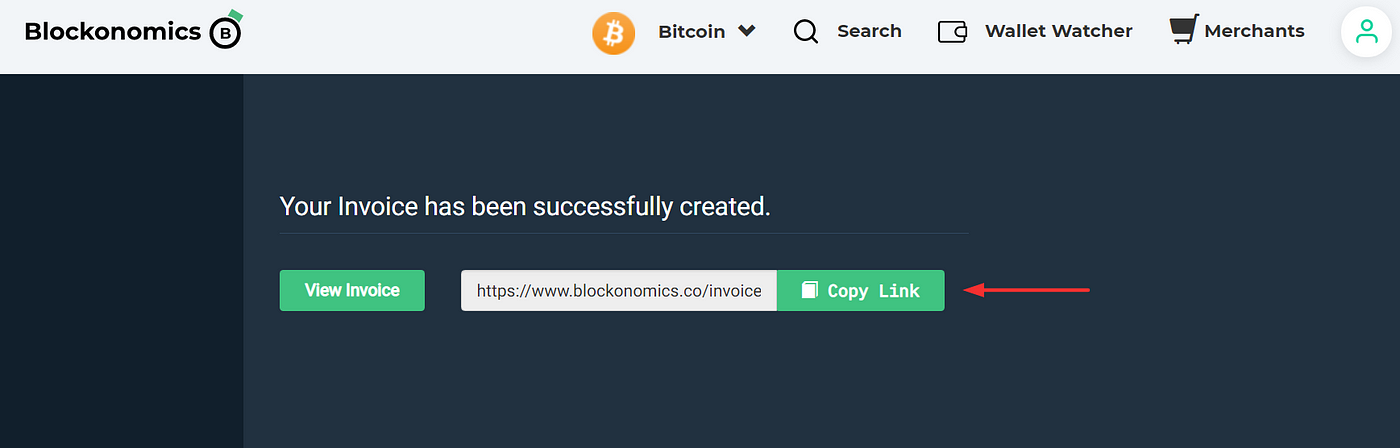

- Review and Send: Ensure that all information is correct before sending the invoice to your client via email or direct link.

Utilizing invoicing software significantly simplifies the process, allowing you to focus more on your business while ensuring accuracy in your billing.

Creating a Custom Bitcoin Invoice Template

If you’re keen on adding a personal touch to your invoices, consider designing a custom Bitcoin invoice template. A well-designed template should include:

- Your Branding: Incorporate your logo, brand colors, and fonts to enhance professionalism.

- Invoice Structure: Clearly outline sections such as header, client information, itemized list of services, payment instructions, and total amount due.

- Call-To-Action: Encourage prompt payment by highlighting payment terms and how easy it is to pay using Bitcoin.

Creating a custom template not only reflects your brand identity but also makes it easier for clients to understand their obligations, enhancing the overall experience of invoicing in Bitcoin.

Best Practices for Secure and Accurate Bitcoin Invoicing

With the rise of Bitcoin comes the necessity for enhanced security measures in invoicing. You must adopt best practices to safeguard both your financial assets and sensitive data during each transaction.

Implementing Strong Security Measures

Security should be at the forefront of your invoicing process. Consider these practices:

- Use Strong Passwords: Ensure all accounts related to your Bitcoin wallet and invoicing software are protected with complex passwords.

- Enable Two-Factor Authentication: This adds an additional layer of security by requiring a second form of verification alongside your password.

- Regular Software Updates: Keep your wallet and invoicing software updated to protect against vulnerabilities and exploits.

These steps help create a fortified environment for all transactions, reducing risks associated with cyber threats.

Maintaining Accurate Records

Accuracy in invoicing is crucial for both operational efficiency and compliance with tax regulations. To maintain accurate records:

- Track All Transactions: Use your invoicing platform to monitor every Bitcoin transaction meticulously.

- Document Changes: If there are any amendments to invoices, document them thoroughly to avoid confusion down the line.

- Regular Audits: Periodically review your invoices and transaction records to ensure everything aligns and is accounted for.

Accurate record-keeping not only enables you to track cash flow but also provides essential documentation when preparing for tax season.

Clear Communication with Clients

A key element of successful invoicing lies in the communication with your clients. Clear communication can prevent misunderstandings and foster stronger relationships. To achieve this:

- Outline Payment Instructions: Be explicit about how clients should make payments in Bitcoin and provide them with your wallet address.

- Respond Promptly to Queries: Address any client inquiries regarding invoices swiftly to promote trust and reduce payment delays.

- Follow Up on Unpaid Invoices: Maintain professional correspondence if payments are delayed, while being mindful of the tone.

Good communication practices can turn an otherwise straightforward process into a positive experience for both parties, promoting repeat business.

Complying with Tax Regulations When Invoicing in Bitcoin

One aspect that business owners often overlook when invoicing in Bitcoin is the legal and tax implications. It’s essential to understand how Bitcoin transactions are treated under tax laws to stay compliant.

Understanding Bitcoin Taxation

In many jurisdictions, the taxation of cryptocurrencies falls under capital gains tax rather than regular income tax. Here’s what to consider:

- Transactions as Property: Most countries view Bitcoin as property. Therefore, when you sell goods or services for Bitcoin, you may incur capital gains taxes based on the appreciation of Bitcoin since its acquisition.

- Record-Keeping for Tax Purposes: Maintain detailed records of all Bitcoin transactions, including the date of the transaction, value in your local currency at the time, and any fees incurred.

- Taxable Events: Familiarize yourself with what constitutes a taxable event in your jurisdiction. For instance, receiving Bitcoin as payment is usually a taxable event.

Understanding these guidelines ensures that you remain compliant and avoid potential penalties from tax agencies.

Hiring a Tax Professional

Given the complexities surrounding cryptocurrency taxation, hiring a tax professional familiar with Bitcoin can save you both time and headaches. A tax advisor can provide insights on:

- Best Practices for Reporting Income: Learn the most efficient ways to report Bitcoin income on your tax returns.

- Tax Planning Strategies: Explore strategies to minimize your tax liabilities associated with cryptocurrency transactions.

- Current Tax Legislation: Stay informed about changes in legislation regarding cryptocurrency, ensuring your business practices remain compliant.

Investing in professional advice can yield dividends in avoiding costly mistakes and maximizing your financial benefits.

Staying Updated on Regulations

Cryptocurrency regulations are constantly evolving, so staying informed is vital. Engage with resources such as:

- Official Government Websites: Regularly check government sites for updates on cryptocurrency regulations and tax guidance.

- Cryptocurrency Communities: Join forums and communities discussing Bitcoin and tax compliance.

- News Outlets Specializing in Cryptocurrency: Subscribe to industry-specific news outlets that provide timely updates on regulatory changes affecting cryptocurrencies.

By remaining aware of regulatory shifts, you can preemptively adjust your business practices, securing your interests in the ever-changing landscape of cryptocurrency.

Benefits and Drawbacks of Using Bitcoin for Invoicing

While the allure of Bitcoin invoicing is evident, it is essential to weigh both its advantages and disadvantages. Understanding these aspects will help you make informed decisions suited to your business model.

Benefits of Bitcoin Invoicing

The benefits of using Bitcoin for invoicing are compelling:

- Speed: Bitcoin transactions can be completed within minutes, expediting your cash flow and enabling quicker service delivery.

- Cost-Efficiency: As mentioned earlier, Bitcoin reduces transactional fees dramatically compared to traditional banking systems.

- Global Reach: Accepting Bitcoin allows businesses to engage with a worldwide customer base without worrying about currency conversions or foreign transaction fees.

These benefits can enhance your competitive edge, especially in industries where timely payments are critical.

Drawbacks of Bitcoin Invoicing

Despite its advantages, there are notable drawbacks to consider:

- Volatility: Bitcoin’s value fluctuates wildly, leading to the risk of accepting payments worth less than anticipated when converted to traditional currency.

- Regulatory Uncertainty: As governments continue to grapple with cryptocurrency regulations, businesses face uncertainties that may impact their operations.

- Technical Learning Curve: Not all clients may be comfortable dealing with cryptocurrencies. Hence, it could limit your customer base or complicate transactions for less tech-savvy individuals.

Weighing these drawbacks will enable you to devise strategies to mitigate risks associated with Bitcoin invoicing while harnessing its benefits.

Conclusion

Invoicing in Bitcoin presents a transformative opportunity for businesses willing to embrace the future of cryptocurrency. By understanding how to invoice in Bitcoin, setting up a secure wallet, and employing best practices, you can streamline your payment processes. Moreover, paying attention to tax compliance and weighing both benefits and drawbacks can enhance your business’s operational efficacy while minimizing risks. As the world moves toward a more digital economy, mastering Bitcoin invoicing sets the stage for success in an increasingly competitive landscape.