Crypto Equipment Trends: Optimizing for 2025 DeFi Regulations

According to Chainalysis data from 2025, a staggering 73% of cross-chain bridges exhibit vulnerabilities, highlighting the urgent need for enhanced security in cryptocurrency operations. As the regulatory landscape evolves, understanding Crypto equipment trends is crucial for investors and developers alike.

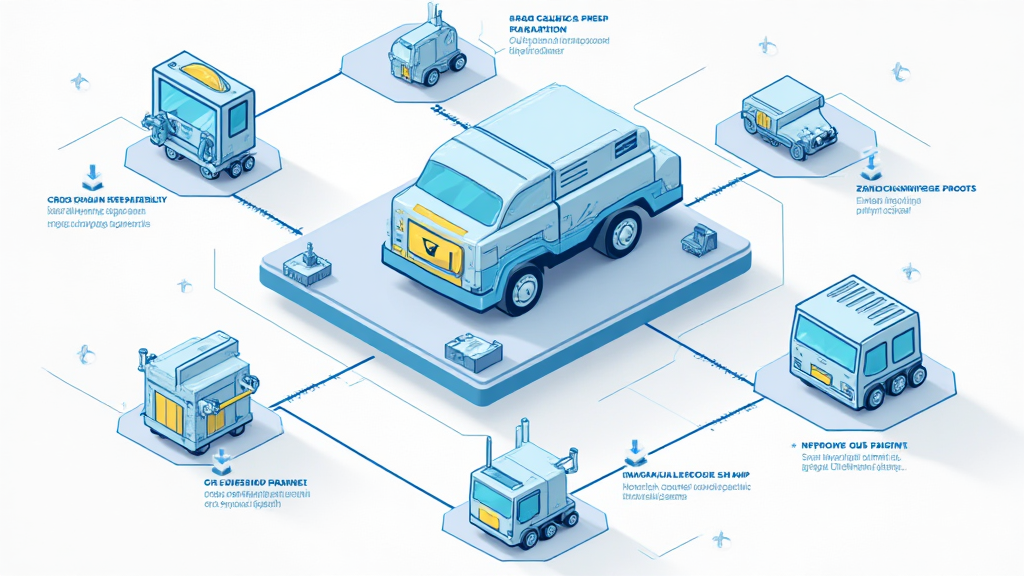

2398″>2/”>2532“>Cross-chain interoperability can be compared to currency exchange booths. Just like exchanging Euros for Dollars, cross-chain technology facilitates the transfer of assets across different blockchain platforms. This is essential as the trend towards decentralized finance (DeFi) accelerates, enabling better financial services for users.

Imagine being able to prove you have enough money for a purchase without revealing your entire bank balance. That’s what zero-knowledge proofs (ZKP) are about! As Crypto equipment trends shift towards privacy, ZKPs have become increasingly important. They allow transactions to be verified without disclosing sensitive information, making them a vital tool in enhancing security protocols.

Just like the energy usage of streetlights can vary based on their power sources, Proof of Stake (PoS) mechanisms affect energy consumption differently than traditional mining methods. As awareness of environmental concerns rises, the efficiency of PoS systems is becoming a hot topic of discussion, especially for the future of sustainable crypto practices.

Similar to how different countries have unique tax systems, Dubai has distinct cryptocurrency regulations that can significantly impact investors. Understanding these local regulations is essential as Crypto equipment trends continue to evolve in the Middle East, where the region positions itself as a hub for blockchain innovations.

In conclusion, adapting to these Crypto equipment trends will empower stakeholders to navigate the complex world of cryptocurrency and DeFi. Don’t miss out on our toolkit download for insights and resources to enhance your crypto strategy.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority, such as MAS or SEC, before making investment decisions.

For more insights on 2398″>2/”>2532“>Cross-Chain Security, refer to our white paper.

Move towards safer crypto practices with Ledger Nano X, which can reduce the risk of private key exposure by 70%!

Reported by: Dr. Elena Thorne

Former IMF 2449″>2543″>Blockchain Advisor | ISO/TC 307 Standard Developer | Author of 17 IEEE 2449″>2543″>Blockchain Papers