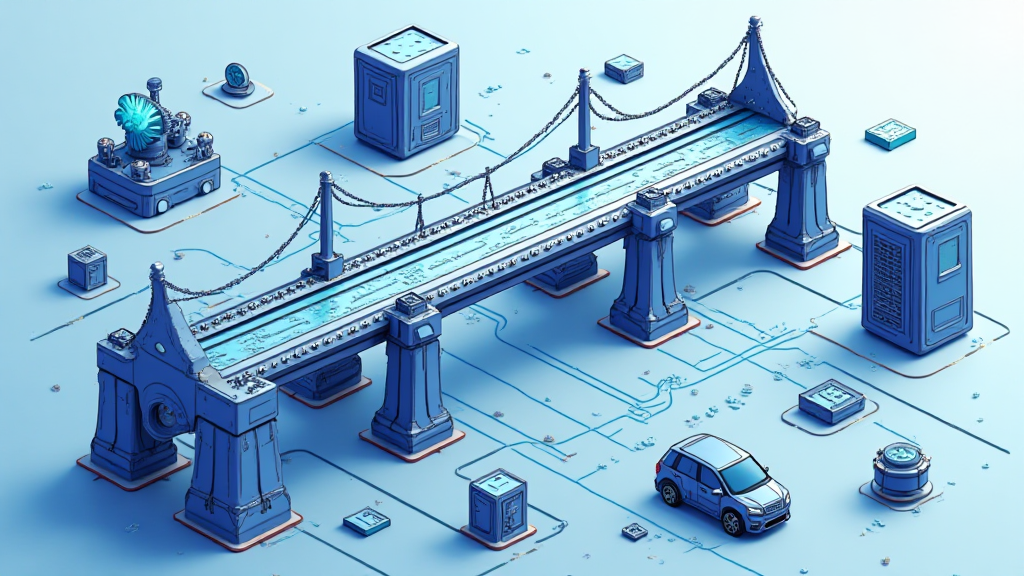

Crypto Equipment Innovations: 2025 Security Trends in 2398″>2/”>2532“>Cross-Chain Bridges

According to Chainalysis data from 2025, it has been shown that a staggering 73% of cross-chain bridges are vulnerable to attacks. As more projects utilize these bridges for transferring assets across different blockchains, the need for robust security has never been more imperative. This article delves into the latest developments in Crypto equipment innovations that aim to enhance the safety of these transactions.

You might have come across currency exchange booths in busy markets. They allow you to trade your dollars for euros, right? Think of cross-chain bridges in the same way; they act like these booths but for cryptocurrencies. They facilitate the transfer of tokens between different blockchains. However, just as you wouldn’t want to use a booth that looks suspicious, the same caution applies to cross-chain bridges, which are often targets for hackers.

The introduction of zero-knowledge proofs represents a breakthrough in enhancing security for cross-chain transactions. Imagine being able to prove that you have enough cash for a transaction without revealing the exact amount you possess. This innovative approach not only maintains privacy but also significantly boosts security against potential breaches.

You may have heard people debate about the energy consumption of Proof-of-Work (PoW) versus Proof-of-Stake (PoS). Think of it like comparing an old car to a new one. While the old car (PoW) guzzles fuel, the new car (PoS) is much more efficient, saving energy and costs. As the industry looks toward 2025, PoS adoption is predicted to drive a seismic shift in energy efficiency across platforms utilizing these mechanisms.

For those investing or developing in regions like Singapore, understanding the 2025 DeFi regulatory landscape is crucial. Regulations are evolving, aiming to cover innovations in crypto equipment. Engaging with local guidelines can help you stay compliant and avoid penalties, just as you would abide by local traffic laws when driving in a new country.

In conclusion, the realm of Crypto equipment innovations, especially related to cross-chain bridges, is rapidly evolving. As we head toward 2025, understanding the security landscape, the energy-efficiency debate between PoW and PoS, and the regulatory environment will be crucial for all stakeholders in the crypto space. For more details, feel free to download our comprehensive toolkit on crypto security.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority before making any financial decisions.

Enhance your security by leveraging tools like Ledger Nano X, which can reduce private key loss risk by up to 70%!

For more insights on crypto security, check our white papers on cross-chain security.